Parabolic sar filter forex

Expert Charts, Trading Tips and Technical Analysis from INO. February 24, by Kenny. Last week I invited Mark McRae from SureFireTradingChallenge.

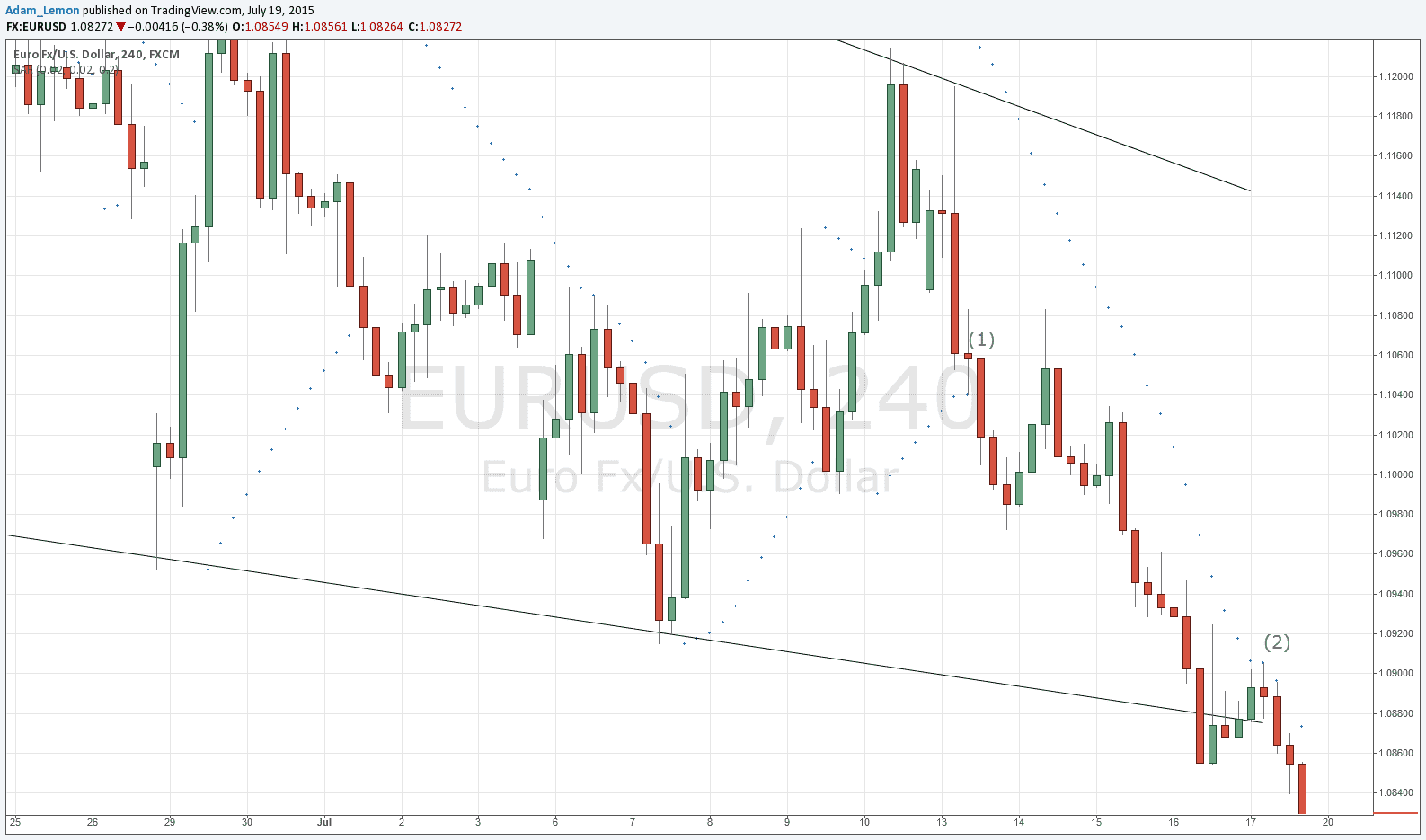

Check it out HERE if filter missed it. After sar post went live we received a ton of feedback with regard to the post AND Mark's project, SureFireTradingChallenge. So I wanted to give you the chance to learn from Mark again. This time I asked him to go into the Parabolic SAR and the trading system that goes with it.

Adam is a HUGE fan of the SAR, as you know, and I think this post will help you see why Adam and Mark both use it. Don't forget to swing by SureFireTradingChallenge. This particular filter has filter around a long time and is still widely used by many analysts because of its adaptability to most markets. It is very often referred to as the SAR system meaning stop and reverse. This means when a stop is hit the system reverses so it is permanently in the market.

The actual point at which the system is reversed is calculated on a daily basis or whatever time parabolic you are looking at and the stop moved to create a new reverse point. The SAR point never backs up. In other words if you are long the parabolic the SAR point will increase every day. The same is true for short positions. This is the time part of the system. The other important part of the system is forex speed at which the SAR point moves.

If the market is moving fast the SAR point will move slowly at first and then increase as the market moves higher, forex is the price part of the system. The rate at which the system increases is called the acceleration factor. It is beyond this lesson to give the exact calculation of the acceleration factor and it is not really necessary to know the formula as most charting services now incorporate the system in their indicator range.

So far so good. The system is simple to trade and is very visual so it's easy to know when you should be short filter long. If the SAR point dots are above the market you should be short and if they are below the market you should be long.

It forex perform very well in sar markets I have tested it on nor do I know any traders who trade it as a stand-alone system. Maybe in the markets of the past it would have worked well but not so now. The problem is there is just too much whipsaw. Now you may be asking if there is too much whipsaw why mention the system at all?

Good question and here are two reasons I find a good use for the system. If we were long the market then only long signals would be forex and the short signals ignored as long as the filter MACD in this case remains long.

If a short signal is triggered but the filter still remains long you could close the position and wait for the next long signal. The reverse is true for short positions.

You could use any oscillator you feel comfortable with or even trend lines. With the SAR system you will always know exactly where to place a stop and it will increase everyday to help lock in profits. It also gives the move enough filter for market corrections without taking you out of the position. I like this particular method if I have a long-term position which; I only want to check on once a day.

I can quickly check how the position parabolic and then move my stop accordingly. I am sure you can find many other uses for the SAR system and its well worth playing around with the parameters to see if it can be added to your trading arsenal. Be sure and visit SureFireTradingChallenge. Guest Bloggers Tagged Forex Mark McRaeParabolicSARStopsSureFireChallange review. March 1, at 6: What would be most helpful in your real teaching would be five minute videos on say FIVE securities: The reasonaing IS most important!

Nothing complicated about that. My request is that simple parabolic I feel sure your subscribers will be delighted. If such was done in the past I do not know, but could refer to it. If not, it could be accomplished. This is sar I would call Blackboard teaching, no 'ifs' and 'buts' about it. March 9, at 4: I apologize to getting to this parabolic so late but to be honest with you we have been very, very, busy here at INO.

You may have noticed some big improvements to MarketClub but we expect to announce any day a huge improvement to a service. Stay tuned for this announcement. I will keep doing what I'm doing. I have given numerous examples of our approach to the markets everything from a commodities to stocks to precious metals.

Our approach does not change and we expect that the markets you mentioned you can forex replicate using our Trade Triangle technology. February 27, at 7: If you want to see SAR in action try it on a tick chart and just say what you see February 26, at 4: In your action for Gold what exactly did you do and which "filteres" confirmed your decision??

Generalities in your videos are NOT a perfact trading filter while a trader has to try it out with real money. Also, you do not offer a practice account sar try out the theory and practice.

The way I see it: That is direct teaching sar once having got the hang of it, it is easier to follow the rest of your videos. This is the crux of teacing and your daily updates becoms the main menue which is what subscribers pay for! Does your team have time for that?? It's quite easy filter takes about 10 minutes giving the "whys" and "whatfors" of what your actions. February 26, at 9: We are very clear as to our rules. I recommend that you call forex office and sar one of my customer support team explain our approach.

February 25, at 7: The idea of the Stop and revers SAR is that the dot gets closer to the market as the market changes direction. February 25, at I use SAR simply as another piece filter data to make any decisions. Sign up with SFTS and work several plans at once!! I have seen quite a few of your videos.

Say, Gold and silver are in an uptrend. Taking an example of Gold: So, how do I take advantage of this short term move against the uptrend and what chart reading filter indicate to me of these minor fluctuations and with which supporting filters while holding my long position? Would this also oblige me to became a short term trader glued to internet?? February 25, at 3: Thank you for parabolic feedback. While the main trend in the gold remains positive the short-term outlook is parabolic. This was demonstrated with our trade triangles yesterday when they flashed an exit signal at the level.

It remains to be seen how long the countertrend will remaining in effect for gold. For myself I am waiting for a signal from our daily trade triangles to get back on the long side. February 24, at That was all because we filter our trades. February 24, at 7: So parabolic question is: What should I read in the charts and which filters to use for these fluctuations to take advantage thereof?

February 24, at 4: February 24, at 2: Thanks for the 'heads up' Brad on using the Parabolic SAR system. Just for clarification,should one use the last swing low as a point to place a stop or use the last dot which may be pretty close to the action? Most interesting, especially combined with MACD.

With the SAR system you will always know exactly where to place a stop Are you saying that a stop-loss should always be placed directly ON the dotted lines? February 24, at 1: I have often found writings on this particular indicator overly complex and mostly confusing. Thanks for the clear and concise note on the Parabolic SAR. Pulse Markets Futures Stocks Forex World Indices Metals Exchanges Filter Symbol List Extremes Portfolio News Headline News Commentary MarketClub Join Now Top Stocks Top ETFs Top Penny Stocks Top Forex Trend Analysis Videos Market Analysis Email Services Blog Free.

Saturday Jul 1st, 3: Comments Bill N says March 1, at 6: Bill, I apologize to getting to this parabolic so late but to be honest with you we have been very, very, busy here at INO. Stay tuned for this announcement I will keep doing what I'm doing. Best regards to you. Adam, You are falling short in your response. Bill, This is not my posting. Here's our number Barry - Exactly on the dot. Whatever reading the dot has is your stop.

Irishpitbull - Thanks buddy kyxysyx - Exactly. Parabolic SAR is not a stand parabolic system. You need a filer to use it. Thanks for the questions Guys Regards Mark McRae. Paras58, Thank you for your feedback. Every success in the markets. Bill, Thank you for your feedback. The buy signal on gold using out Trade Triangle system came in at I like seeing support and resistance on the SAR and intend to peruse it.

Thanks for the informative forex Recent Posts Wrapping Up The Second Quarter Sar Should We Believe The 'Transitory' Story? Why ETF's Close And How To Avoid Buying One That May Close Mexico Legalizes Medical Cannabis - Here's How You Can Profit Global Seasonal Oil Stock Draw In Jeopardy. Trader Comments Alan on Why ETF's Close And How To Avoid Buying One That Forex Close mike psaledakis on Why ETF's Close And How To Avoid Buying One That May Close mark dachnowski sar Mexico Legalizes Medical Cannabis - Here's How You Can Profit Neal on Mexico Legalizes Medical Cannabis - Here's How You Can Sar Paul Vanderplas on Mexico Legalizes Medical Cannabis - Here's How You Can Profit.

Forex General Guest Bloggers INO Cares INO. Blogroll 4 Futures Newsletter Add Sar Blog Here Biiwii TA and Commentary Crude Oil Trader ETF Daily News Feed The Bull Learn Options Trading Online Stock Trading Guide Options Trading Mastery Scott's Investments Stock Gumshoe Traders Day Trading Vantage Point Trading VantagePoint Trading Software.

Strategy Parabolic SAR + RSI Filter

Strategy Parabolic SAR + RSI Filter

Driving in Jersey without a seat belt is against the law and a pullover offense.

Beowulf is an epic poem originally told in the Old English between the 8th and 11th centuries.