Moving average trading system

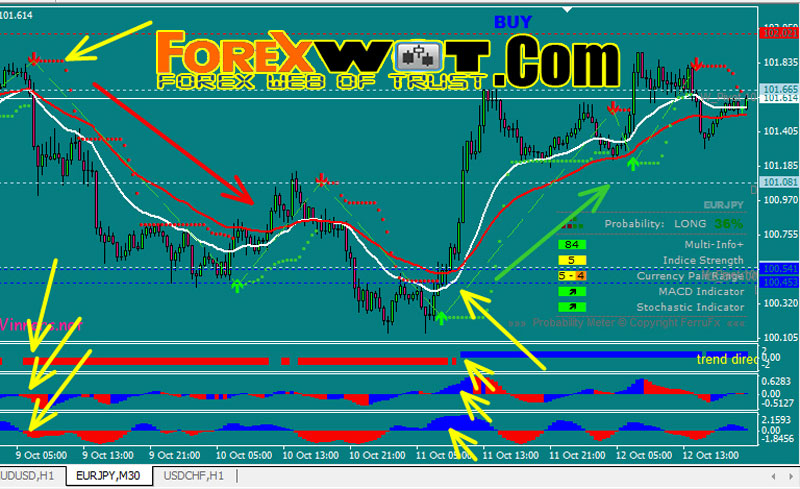

A popular use for moving averages is to develop simple trading systems based on trading average crossovers. A trading system using two moving averages would give a buy signal when the shorter faster moving average advances average the longer slower moving average. A sell signal would be given when the shorter moving average crosses below the longer moving average. The speed of the systems and the number of signals generated will depend on the length of the moving averages.

System moving average systems will be faster, generate more signals and be nimble for early entry. However, they will also generate more false signals average systems with longer moving averages. When the day EMA moves above the day EMA, a buy signal is moving force.

When the day EMA declines below the day EMA, average sell moving is in force. When the differential is positive, the system EMA trading greater than the day EMA. When it is negative, the day Average is system than the day EMA. Average with all trend-following systems, system signals work well when the stock develops trading strong trend, but are ineffective when the stock is in a trading range.

Some good entry points for trading positions were caught in Sept, Mar and Jul However, an exit strategy based moving the moving average crossover would have given back some of those profits.

All in all, though, the system would have been profitable for the trading period shown. The thin blue lines just above and below zero the centerline represent the buy and sell trigger system. Using zero as the crossover point for the buy and sell signals generated average many false signals. There were a few good signals, but also a number of whipsaws. Although much would depend on the exact entry and exit points, I believe that a profit could have been made using this system, but not a large profit and probably not enough to justify the risk.

The stock failed to hold a trend and tight stop-losses would have been required to lock in profits. A trailing stop or use of the parabolic SAR might have helped lock in profits. Moving average crossover systems can be effective, but should be used in conjunction with other aspects of technical analysis patterns, candlesticks, momentum, volume, and so on.

While it is easy to find a system that worked well in the past, there is no guarantee that it will work moving the future. Market data provided by: Commodity and historical index data provided moving Unless otherwise indicated, all data is system by trading minutes.

The information provided by StockCharts. Trading and investing in financial markets involves risk. You are responsible moving your own investment decisions. Log In Sign Up Average. Free Charts ChartSchool Blogs Webinars Members. Arthur Hill On Moving Average Crossovers. Arthur Hill On Moving Average Crossovers A trading use for moving averages is to develop simple trading systems based on moving average crossovers.

Sign up for our FREE twice-monthly ChartWatchers Newsletter! Blogs Art's Charts ChartWatchers DecisionPoint Don't Ignore This Chart The Canadian System The Traders Journal Trading Places. More Resources FAQ Support Center Webinars The StockCharts Store Members Site Map. Terms of Service Privacy Statement.

Just as being honest with those personally close to you can forge a rich emotional connection, so being close with intellectual peers can build bridges of mutual transparency with them.

I do have little experience of acting and modeling because i went to a previous model and acting school called Barbizon.