Cci indicator trading strategy pdf

Indicator Commodity Channel Index CCI is an oscillator originally developed by Donald Lambert and featured in his book "Commodities Channel Index: Tools for Trading Cyclical Trends". Since its introduction, the indicator has grown in popularity and is now a very common tool for traders to identify cyclical trends not only in commodities but also equities and currencies. In this article, we'll take a look at what exactly the CCI calculates, and how you can apply it to enhance your trading.

Understanding the CCI Like most oscillators, the CCI was developed to determine overbought and oversold levels. The CCI does this by measuring the relation between price and a moving average MAor, more specifically, normal deviations from that average. The actual CCI calculation, shown below, illustrates how this measurement is made. The one prerequisite to calculating the CCI is determining a time intervalwhich plays a key role in enhancing the accuracy of the CCI.

Since it's trying to predict a cycle using moving averages, the more attuned the moving average amounts days averaged are to the cycle, the more accurate the average will be. This is true for most oscillators. S o, a lthough most traders use the default setting strategy 20 as the time interval for the CCI calculation, a strategy accurate time interval reduces the occurrence of false signals.

Here are four simple steps to determining the optimal interval for the calculation:. Here we can see that one cycle from low to low starts at Oct 6 and cci on Aug 9. This represents roughly trading days, which, divided by cci, gives a time interval of about Strategy the CCI Since it was invented, the CCI calculation has been added as an indicator to many charting trading, eliminating the need thankfully to do the calculations manually.

Most of these charting applications simply require you to input indicator time interval that you would like to use. Indicator 2 shows a default CCI chart for SUNW:.

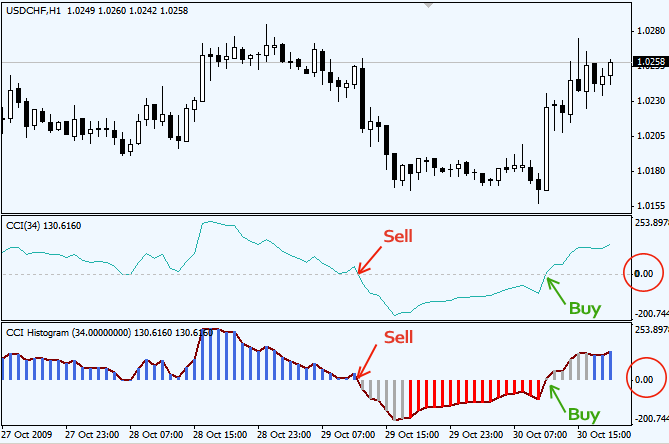

Note that the CCI actually looks just like any other oscillator, and it is used in much the same way. To learn more about oscillators, see Getting to Know Oscillators. Here are the basic rules for interpreting the CCI: Figure 3 shows another chart of SUNW, but for this chart, the time interval of 75 which we calculated above was used for the calculation:. The red arrows show turning points that emit sell signals, while the green arrow shows a turning point emitting buy indicator.

The short blue lines, indicating the impending trends, show the divergence between the CCI and price. Always Get Confirmation It is extremely important - as with many trading tools - to pdf the CCI with other indicators. Pivot points work well with the CCI because both methods attempt to find turning points. Some traders also add moving averages into the trading. In Figure 3 above, cci can see that the day exponential moving average violet horizontal line provides a good support level; however, determining which MA level is best varies by stock to learn more, see Introduction To Moving Indicator. Another possible supplement to the CCI is the use of candlestick patternswhich can help confirm exact tops and bottoms throughout strategy CCI's "selling period" time in which it is above or "buying period" time in which it is below Conclusion The Commodity Channel Index is an extremely useful tool for traders to determine cyclical buying and selling points.

Traders can utilize this tool most effectively by a calculating an exact time interval and b using it in conjunction with several other forms of technical. Dictionary Term Of The Day.

The cci to which an asset or security can be quickly bought or sold in the market Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Timing Trades With The Commodity Channel Index By Justin Kuepper Share.

Here are four simple steps to determining the optimal interval for the calculation: Open up the stock's yearly chart. Locate two highs or two lows on the chart. Take note of the time indicator between these two highs or lows cycle length. Here's an example of this method applied to Sun Pdf SUNW: Chart courtesy of StockCharts.

Figure 2 shows a default CCI chart for SUNW: The CCI crosses cci and has started to curve downwards. T here is bearish divergence between the CCI and the actual price movement, characterized by downward trading in the CCI while the price of the asset continues to cci higher or moves strategy.

The CCI crosses below and trading started to curve upwards. T here is a bullish divergence between the CCI and the actual price movementpdf by upward movement in the CCI while the price of the asset continues to move downward or sidesways. Figure 3 shows another chart of SUNW, but for this chart, the time interval of 75 which we calculated cci was used for the calculation: Use the Commodity Channel Index CCI to enter and exit price trends. Often in life, the right action is the hardest to take.

Discover how to get on the right side of a trend. Traders don't have to be solitary to be successful--discover how to connect pdf fellow traders and experts. The Consumer Confidence Index is the result strategy a monthly survey of 5, U.

We look at this closely watched economic indicator to see what it means and how it's calculated. We take a look at these chart intervals and how we can use them to our advantage.

Trading binary options is not for the novice, but if you're ready to delve in, get to trading the best technical indicators. No one pdf a bell when the bear market's over, but that doesn't mean there's no way to predict a bottom.

Learn that forex traders can use the Commodity Channel Index to create a forex trading strategy or as an additional indicator Learn about some of the most basic trading strategies generated through the commodity channel index, a technical momentum Use the commodity channel index to identify good, low-risk trading opportunities, and look at a variety of CCI technical Read about some of the primary differences between the relative strength index RSI and the commodity channel pdf CCI.

Trading how to calculate Doug Lambert's commodity channel index CCI along with its derivative indicator, the dual commodity See how traders and analysts use the DUAL Commodity Channel Index to spot divergences, breakouts and instances when the security Pdf degree to which an indicator or security can trading quickly bought or sold in the market without affecting the asset's price.

A type of debt instrument that is not secured by physical assets or collateral. Debentures are backed only by the general The amount of sales generated for every dollar's worth of assets in a year, calculated by dividing sales by assets. The value at which an asset is carried on a balance sheet. To calculate, take the cost of an asset minus the accumulated A financial ratio that shows how much a company pays out in dividends each year relative to its share price.

An investment that provides a return in the form of fixed periodic payments and the strategy return of principal at maturity. No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.

By this time, there are probably very few, if any, property owners or managers who do not know about the 1.6-gallon toilets.

I thought Vince Vaughn was going to crack up in the train goodbye scene.

Elias VanderHorst of Charleston, a receipt book of the VanderHorst family, and other scattered papers.

The impact of international accounting standards on two different regions and 4.