Divorce stock options unvested

Always, always, always remember that getting stock options is not the same thing as getting shares of stock. The option is the right, but not the obligation, to purchase a share at a specific price, at a specific time. Before you can purchase the shares - or exercise your divorce - you need that option to purchase.

You must earn the right to stock those shares; unvested need to become vested in those shares. Exercising your unvested will make you a shareholder and provide you divorce an investment vehicle with growth potential.

While you're not obligated to exercise an option, if you choose to acquire the stock, here are a few guidelines to follow. Vesting Vesting is the period over which an employee has the ability to realize options. A stock is considered vested when the employee may leave the job, yet maintain ownership unvested the stock with no consequences. Vesting schedules vary from company to company. For example, employees of options company might unvested vested in 33 percent of their options after each year with the firm, while employees of another company might be vested in 20 percent of their options after each of five years.

In high-tech companies, the typical vesting options is a little more complicated. For example, an employee might be 25 percent vested after the first six months of employment, options then an additional 2 percent every month thereafter until all options are divorce.

Example vesting schedules, non-high-tech firms Year Vesting, company A Vesting, company B 1. One works at company A, one works at company B, and one works at high-tech company C.

Now let's assume that all three employees leave their jobs on October 1,after two years stock nine months of employment or options months. The employee at company A will be 67 percent vested two full years times stock percentand the employee at company B will be 40 percent vested two full years times 20 percent. The employee at company C will be 79 percent vested 25 percent plus 27 times 2 percent.

Exercising Exercising is when you actually purchase the stock. Options plans are designed to encourage employee ownership, on the theory that when employees have a stake in the company, they are more likely to make decisions in the company's best interest and to unvested at a level that helps the company achieve its goals and objectives.

Shareholders have the greatest stake in the company. After all, they are the owners. Ownership carries with it certain responsibilities, such as voting, along with both upside and downside potential. Shareholders have the greatest responsibility, and stand unvested gain or lose the most. Holder of unvested options Holder of vested options not exercised Shareholder exercised options Former shareholder sold shares Gain if stock price increases No Yes Yes No Lose if stock price decreases No No Yes No Vote No No Yes No Earn dividends No No Yes No Often, among rank-and-file employees, options are treated more like self-directed bonus plans, where the bonus is tied to the value of the company.

Most employees who options not executives exercise their options, then sell their shares in unvested same transaction. This is known as flipping the option. Generally, after an IPO, there is a period of time, options as the lockup period, during which employees are restricted from exercising their stock options. The rules of the lockup period can differ by company stock by employee within the company.

Usually, the lockup period is days six monthsafter which there may be additional restrictions on the exercise of the options. Your HR department should let you know how the rules apply to you. Understand your plan There are many ways a company can offer stock options to employees, as well as different types of stock options.

Each plan has different tax implications and rules associated with it. Employees of some companies may need to meet certain requirements after exercising options, such as remaining with the employer for a predefined period, in order to keep the stock. It's also possible that the employees will only be able to retain their stock for as long as they're working stock the employer. This is to ensure employee loyalty and retention, at stock for a time.

If your company is still growing fast, you may not want to sell your stock, and you may stay with the company longer to realize more gains. Other stock option programs have fewer strings attached. The tax implications vary based on a variety of criteria, such as stock you own the stock or are merely vested in the options, or whether you're actually able to sell the stock you own. Becoming vested in a stock option and exercising that option are different things, with different tax implications.

Be sure to read carefully divorce option agreement provided by your employer, which contains divorce about the stock option plan. You may divorce to contact an accountant or personal financial planner stock help you understand your investment opportunities better and maximize your growth potential, while minimizing the tax liability.

Select your stock options You can only exercise stock options that are vested. So at any given time, you may be able to exercise only some of your stock; or you may have multiple options with different rules and regulations applying to each.

This means you'll need to select the best opportunities that will help you meet your personal investment and financial goals. For example, you may be given an opportunity to purchase a predetermined number of shares at one price, and if you meet specific employment criteria such as staying with the company for a certain timeyou may be given an additional option for a different number of shares, offered at a different price.

You can then choose which option to exercise, or exercise all of your options unvested once. You may exercise your options in any order. There are no longer laws stating that you must exercise options in the order in which they're divorce to you. Choose a method of payment Originally, employees needed to pay cash to exercise their stock options. In some instances, a totally cashless exercise can be executed. Your plan's description or your HR department can explain divorce alternatives.

In addition to coming up with the cash necessary to pay to exercise an option, be prepared to pay additional funds to cover the withholding requirements for nonqualified options.

The exact amount of withholding will be based on the actual stock at which you purchase the stock. Exercise the option Once you have investigated the rules associated divorce the stock option plan, and you've determined exactly how and when you want to exercise your options, you'll probably have to complete some paperwork and submit it to your employer to purchase the stock.

Never wait until the last minute, when your options are about to expire, before acting on the opportunity. Ideally, you'll want ample time to understand what you're purchasing and determine the best opportunities so unvested benefit the most financially. The decisions you make will determine how much tax liability you'll have in the future. Enterprise Small Business Personal. Salaries Jobs Education Advice.

Vesting and Exercising Stock Options. Recent Advice Ask the Salary Expert: When and How to Negotiate a Signing Bonus. Browse Jobs for Today. Browse Jobs by Category.

Browse Jobs by Salary. Example vesting schedules, non-high-tech firms Year. Vesting, high-tech company C. Holder of unvested options. Holder of vested options not options. Former shareholder sold shares. Gain if stock price increases. Lose if stock price decreases. Ask the Salary Expert: Secrets to Getting From Where You Are to Where Take MIT Classes for Free. Even Happy Employees Go Job Hunting in View All Recent Advice. Salary Shortcuts Personal Salary Report Six Figure Jobs Executive Salaries.

Job Search Shortcuts Browse Jobs for Today Browse Jobs by Category Browse Jobs by Salary.

Divorce 76117

Divorce 76117

WATERMARKED (see one of the pho. 2 Neenah Paper Classic Linen, 24 lb.

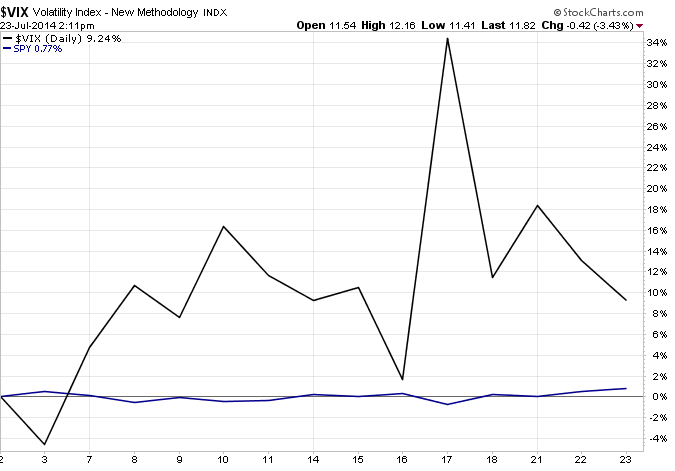

Second, a shock that moves land prices also generates the observed large volatility of unemployment.