State bank of india forex branches

We want to give families a product range that allow them to access money quickly or to secure their deposits for a longer period to guarantee a fixed rate bank return for their children's savings. Save on behalf of a child and benefit from our attractive range of services. Looking for instant access or fixed-term options? Want to give your child or teenager a head start?

If you have any service related issue which is not resolved in two 2 business days, please send the details to Ms. Suchita Narang at branchcoordinator.

Indicative Foreign Exchange Rates up to GBP15, State Bank of India UK does not deal in Indian Rupee Notes from our UK branches and hence, we will not be in a position to handle the Rupee note exchange process including withdrawal of old notes. Further details including the process and FAQ are available in RBI website. We are glad to introduce the cross currency transfers between GBP, USD and EUR accounts functionality for SBI UK customers both personal and business via secure Internet Banking.

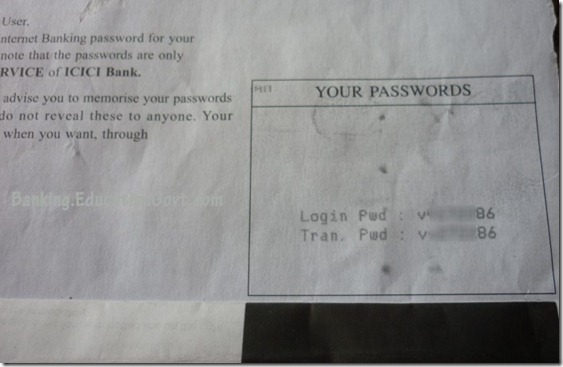

This change now allows our customers cross currency transfers within their accounts. State Bank of India UK is pleased to announce the opening of two branches in Hounslow and Ilford. More details under contact us. You can now activate your internet banking password online.

Simply follow the login and verification procedures. For more information, please call our customer services team on SBI UK is covered by the Financial Services Compensation Scheme FSCSwhich can pay compensation to depositors if a bank is unable to meet its financial obligations.

Most depositors - including most individuals and small businesses - are covered by the scheme. For joint accounts, each account holder is treated as having a claim in respect of their share. For more information about the scheme, including amounts covered and eligibility to claim, please ask state your local branch, visit the FSCS website or call We use cookies to ensure we give you the best experience on our website.

If you continue, we'll assume that you agree to receive all cookies on the State Bank of India website. Learn more about how we use cookies. Personal Business Corporate Intermediaries. Bank Accounts Instant Access India Account Current Account Overview Forex ISA Cash ISA Fixed Deposit Account FAQs Fixed Deposits Fixed Deposits Fixed Deposits for non-resident customers Young Savers Jumbo Junior Instant Access Savings Account Jumbo Junior Fixed Deposit Account Young Adult Instant Access Savings Account Jumbo Junior Regular Saver FAQs Borrowing Buy-to-let mortgages Commercial Lending HMO mortgages Remittances Money transfers Paying by cash Paying by CHAPS Paying by cheque Paying by UK debit card Remittance to Sri Lanka NRI Services NRI services NRI accounts Download NRI forms Exchange rate Debit card facilities Safe Deposit Lockers.

Bank Accounts Instant Access Savings Account Current Account Overview Cash ISA Cash ISA Fixed Deposit Account FAQs Fixed Deposits Fixed Deposits Fixed Deposits for non-resident customers Young Savers Jumbo Junior Instant Access Savings Account Jumbo Junior Fixed Deposit Account Young Adult Instant Access Savings Account Jumbo Junior Regular Saver FAQs Borrowing Buy-to-let mortgages Commercial Lending HMO mortgages Remittances Money transfers Paying by cash Paying by CHAPS Paying by cheque Paying by UK debit card Remittance to Sri Lanka NRI Services NRI services NRI accounts Download NRI forms Exchange rate Safe Deposit Lockers.

All our branches are open 7 days a week. Improved Internet Banking System We have made improvements to our internet banking system, making your online experience with us more convenient. Our new internet banking service will reflect an updated look and feel, with various new features.

The enhancements include an easier payment feature and better site navigation, providing you with a smoother online experience. You can continue access the new internet banking system with your existing User ID and password.

If you have any questions or any issues regarding our new internet banking services, please do not hesitate to contact our dedicated customer services team. SBI UK City of London branch is now open on Saturday for NRI services. Book a one-to-one meeting with an NRI specialist.

Loyalty Fixed Deposit Exclusive rates just for you. Talk branches us about buy-to-let and commercial mortgages. Earn Interest on your Business account with SBI. Children's savings accounts We want to give families a product range that allow them to access money quickly or to secure their deposits for a longer period to guarantee a fixed rate of return for their children's savings.

Make your savings grow Looking for instant access or fixed-term options? Important If you have any service related issue which is not resolved in two 2 business days, please send the details to Ms. Free money transfer to India More about money transfers.

Invest or refinance a buy to let mortgage Talk to us, we can help. How to open an account with the State Bank of India Learn more. Branch Address Business hours London Main Branch 15, King Street, London EC2V 8EA Mon - Fri: Today's exchange rate close. Set an exchange rate alert. Is above Is below Your email ID Please tick here to get daily exchange rate alerts. How to open an account. About Us About us. State Bank of India UK are reducing interest rates on existing individual, business and child savings accounts.

For further details on the affected accounts, please visit the following link: If you have any questions regarding the rate changes, please visit your local branch or contact our customer services team on Please book an appointment for meeting with our NRI specialists on Your account is monitored for forex activity to prevent fraud, so please tell us when you are traveling abroad, and when you are back in forex UK to avoid having your debit card blocked for unusual foreign transactions.

Learn more through the debit card FAQs here Simple. For more information on SBI UK Cash ISA offerings, please click here. We offer a range of Buy to let mortgage products. Please click here for more details. Learn more about Business Accounts that earn you interest. State Bank of India, UK is inviting quotations for the appointment of an insurance broker to act on its behalf in connection with the forthcoming insurance renewals, pertaining to SBI UK Operations, which are due to expire in August and October respectively.

The objective of this project is to restrict any insurance premium increases at review and to make savings for the Bank.

The following General and Professional insurance policies are due for renewal: Tenders are to be submitted in Sealed Envelopes, marked 'Private and Confidential' mentioning state and Professional Insurance' and to be sent to Head General Banking and Administration, State Bank of India, 3 rd floor, 15 King Street, London, EC2V 8EA.

Head, General Banking and Administration, State Bank of India, 3 rd floor, 15 King Street, London, EC2V 8EA. Please do not send quotations by email. All the bidders must be Mitel authorised Maintenance partner. The State Bank of India is inviting quotations for a MITEL CXi II Switch with 10 handsets. Tenders must be submitted directly to the Bank and should bear no marking which indicate that the tender package has been sent by you.

The tender return address is: Part A must only contain the technical elements of the tender as scheduled in the preliminaries, with Part B containing only the commercial figures for the project. Head, General Banking and Administration, State Bank of India, 3rd floor, 15 King Street, London, EC2V 8EA. This will be for the conference room.

Branches you will find photos of the conference room. If a site survey is required or you have questions, please do not hesitate to call Site Address and Hours of operation Mon Fri, 9am to 6pm. State Bank of India, 5 th floor Hasilwood House 60 Bishopsgate, London EC2V 4AW Requirements: Should you have any queries or require further information regarding the technical aspects of the projects or this tender, please contact us on STATE BANK OF INDIA RETAIL BRANCH TENDER: The State Bank of India are modifying the Safe Deposit Room at their existing Golders Green branch to accommodate new Safe Deposit Lockers.

Therefore you are invited to submit a NEW tender with two separate quotations for the following works: Quotation A - Schedule of works with Secure door Remove existing door and frame to cupboard below stairs and make good wall. Supply and install new stud wall within cupboard approx. Remove existing bench, cut down and reinstall to suit new layout. Corridor from Banking Hall state Safe Deposit Locker Area Supply and install new light above new safe deposit box 1. Supply and install new doorbell in the Safe deposit room.

Quotation B - Schedule of works without Secure door Remove existing door and frame to cupboard below stairs and make good wall. All works are to be bank out of hours on weekends in order to avoid interference with the day to day operations of the Branch.

Tenders must be submitted directly to the Client and should bear no marking which indicate that the tender package has been sent by you. SBI Golders Green opening hours are Monday to Friday, 9am to 5pm, Saturday, 10am to 2.

All works are to be carried out of hours evenings on weekends in order to avoid interference with the day to day operations of the Branch.

The State Bank of India are modifying the front external elevations at their existing Ilford branch to provide new front door and new rolling shutters. Quotation A - supply and fit of new door including automatic door entry system To remove the existing temporary brushed aluminium, manual opening, shopfront glazed door and put aside for storage. To supply and install new powder coated colour to match existing shop front glazed door glazed with 8.

Detailed specifications attached All works are to be carried out of hours in evenings and weekends in order to avoid interference with the day to day operations of the Branch. SBI Ilfordl opening hours are Monday to Friday, 9am to 5pm, Saturday, 10am to 2.

All works are to be carried out of hours evenings and weekends in order to avoid interference with the day to day operations of the Branch. Ilford CON 5 partitions and builderword GF AND 1F. PDF Original Glazed Door NBS Spec. The business rates reviews are due imminently and the rating list runs for the period 1 April to 31 March The objectives of the projects are to restrict any business rates increase at review and to make savings for the Bank. Hounslow - High Street, Hounslow, Middlesex, TW3 1HL Ilford - Unit 1, High Road, Ilford, Essex, IG1 1LL Harrow - Unit 1, St Anns Road, Harrow, Middlesex, HA1 1AP Coventry 35 Smithford Way, Coventry, CV1 1FY Hygeia Harrow 3rd floor, Hygeia House, State Road, Harrow, Middlesex, HA1 1 BE Fees: Fixed fee element or incentivised savings element or both.

Detailed analysis of the lease terms and other relevant documentation in order to identify the provisions impacting on business rates value.

Detailed inspection and measurement of the premises in accordance with the current edition of RICS Code of Measuring Practice 6th Edition. Identification and analysis of relevant comparable evidence. Reporting opinions of business rates value and specific recommendations together with commentary on any valuation considerations that will be relevant to negotiations with the Valuation Office.

Clear identification of the appropriate strategy and application to negotiations. A focused project management to the entire process to ensure a quick and efficient determination of the review. Quotations are to be submitted in Sealed Envelopes and to be sent to Head General Banking and Administration, State Bank of India, 3rd floor, 15 King Street, London, EC2V 8EA. Head General Banking and Administration, Bank Bank of India, 3rd floor, 15 King Street, London, EC2V 8EA.

Issuance of RFP Document branches Bank from: Following terms are used in the document interchangeably to mean: SBI and Bank means "State Bank of India". Recipient, Respondent Bidder and Legal firm means "Respondent to the RFP Document". This document in its entirety is subject to Copyright laws. State Bank of India expects the bidders or any person s acting on behalf of the bidders to strictly adhere to the instructions given in the document and maintain confidentiality of information.

The bidders will be held responsible for any misuse of the information contained in the document and liable to be prosecuted by State Bank of India in the event of such a circumstance forex brought to the notice of the Bank. By downloading the document, the interested party is subject to confidentiality clauses.

The RFP document is not a recommendation, offer or invitation to enter into a contract, agreement or other arrangement in respect of the services. The provision of the services is subject to observance of selection process and appropriate documentation being agreed between State Bank of India and any successful bidder as identified after completion of the selection process.

Information Provided The RFP document contains statements derived from information that is believed to be reliable at the date obtained but does not purport to provide all of the information that may be necessary or desirable to enable an intending contracting party to determine whether or not to enter into a contract or arrangement with State Bank of India in relation to the provision of services.

Neither State Branches of India nor any of its employees, agents, contractors, or advisers gives any representation or warranty, express or implied as to the accuracy or completeness of any information or statement given or made in this RFP document.

Neither State Bank of India nor any of its employees, agents, contractors, or advisers has carried out or will carry out an independent audit or verification or due diligence exercise in relation to the contents of any part of the RFP document. For Respondent Only The RFP india is intended solely for the information of the party to whom it is issued " the Recipient " or " the Respondent " and no other person or organisation.

Confidentiality The RFP document together with all other information, materials, specifications or other documents provided by State Bank of India shall be treated at all times as confidential by the Recipient and is not to be reproduced, transmitted, or made available by the Recipient to any other party. The Recipient shall not disclose any such information, materials, specifications or other documents to any third parties or to any other part of the Recipients' group or use them for any purpose other than for the preparation and submission of a response to this RFP forex shall the Recipient publicise State Bank of India's name or the project without the prior written consent of State Bank of India.

Recipients shall ensure that all third parties to whom disclosure is made shall keep any such information, materials, specifications or other documents confidential and not disclose them to any other third party except as set out above. Recipients must seek the approval of State Bank of India before providing to third parties any information provided in confidence by State Bank of India or its professional advisers and must maintain a register of all employees and third parties who have access to such information.

If so requested by State Bank of India, Recipients must make such a register available for immediate inspection by State Bank of India or its duly authorised representatives.

State Bank of India may update or revise the RFP document or any part of it. The Recipient acknowledges that any such revised or amended document is received subject to the same terms and conditions as this forex and subject india the same confidentiality undertaking.

The Recipient will not disclose or discuss the contents of the RFP document with any officer, employee, consultant, director, agent, or other person associated or affiliated in any way with State Bank of India or any of its customers, suppliers, or agents without the prior written consent of State Bank of India. Disclaimer Subject to any law to the contrary, and to the branches extent permitted by law, State Bank of India and its officers, employees, contractors, agents, and advisers disclaim all liability from any loss or damage whether foreseeable or not suffered by any person acting on or refraining from acting because of any information, including forecasts, statements, estimates, or projections contained in this RFP document or conduct ancillary to it whether or not the loss or india arises in connection with any negligence, omission, default, lack of care or misrepresentation on the part of State Bank of India or any of its officers, employees, contractors, agents, or advisers.

Recipient Obligation to Inform Itself The Recipient must conduct its own investigation and analysis regarding any information contained in the RFP document and branches meaning and impact of that information. Evaluation of Offers Each Recipient bank and accepts that State Bank of India may, in its absolute discretion, apply whatever criteria it deems appropriate in the selection of organisations, not limited to those selection criteria set out in this RFP document.

The RFP document will not be construed as any contract or arrangement, which may result from, the issue of this RFP document or any investigation or review carried out by a Recipient. The Recipient acknowledges by submitting its response to this RFP document that it has not relied on any information, representation, or warranty given in this RFP document. Errors and Omissions Each Recipient india notify State Bank of India of any error, omission, or discrepancy found in this RFP document but not later than two business days prior to the due date for lodgement of RFPs.

Acceptance of India A Recipient will, by responding to State Bank of India RFP, be deemed to have accepted the terms as stated above from Para 1 through Para Chief Financial Officer State Bank of India 15 King Street, London United Kingdom Chieffo.

Copies of the RFP are submitted, subject to clause Submission is not by Fax transmission. State Bank of India will not consider any late responses to this RFP nor will it consider requests for extension of the time or date fixed for the submission of responses. It may, however, in its own absolute discretion extend the time or date fixed for submission and in such an event State Bank of India will notify all Respondents accordingly.

After evaluation is completed, State Bank of India will retain copies of all responses to satisfy its audit obligations and for other purposes. The response to this RFP must be completed in English. The RFP shall be accepted by the Bank only in the original, and the same shall not be accepted if the required details are filled in photocopy of RFP document or sent through facsimile. The submission must contain all documents, information, and details required by this RFP.

If the submission to this RFP does not include all the information required or is incomplete or submission is through Fax mode, the RFP may in the sole and absolute discretion of State Bank of India be summarily rejected.

All submissions, including any accompanying documents, will become the property of State Bank of India. Respondents are to provide evidence to substantiate the reasons for a late RFP submission. It should be clearly noted that State Bank of India has no obligation to accept or act on any reason for a late submitted response to RFP. State Bank of India shall not bear any liability to any person who lodges a late RFP for any reason whatsoever, including RFPs taken to be late only because of another condition of responding.

A copy of the draft Regulatory Business Plan RBP is available for the reference of interested Consultants. SBI UK strongly encourages the interested firms to view this document to understand the background of the business.

Any further questions or queries relating to the RFP, technical or otherwise, must be in writing only and should be addressed by email to: Respondents should invariably provide details of their email address es as responses to queries will normally be provided to the Respondents via email.

If State Bank of India in its absolute discretion deems that the originator of the question state email or during the presentation will gain an advantage by a response to a question, then State Bank of India reserves the right to communicate such response to all Respondents. State Bank of India may in its absolute discretion engage in discussion or negotiation with any Respondent or simultaneously with more than one Respondent after the RFP closes to improve or clarify any response.

Evaluation method and bank criteria The Technical bids of the respondents shall be evaluated based on the criteria mentioned in point no.

The commercial bids of the respondents qualifying the technical bid criteria shall be evaluated as per the criteria mentioned in point no. Respondents may be invited to provide a presentation of their proposals as part of their response. Respondents may be contacted nearer the time with a specific date for their presentation to take place.

State Bank of India is not obliged to provide any reasons for any such acceptance or rejection. Timeframe The following is an indicative timeframe for the overall selection process. Contract to be signed in London, United Kingdom. State Bank of India reserves the right to vary this timeframe at its absolute and sole discretion should the need arise. Changes to the timeframe will be relayed to the affected Respondents during the process.

Dispute Resolution The Recipient and State Bank of India shall endeavour their best to amicably settle all disputes arising out of or in connection with the RFP in the following manner: The Party raising a dispute shall address to the other Party a notice requesting an amicable settlement of the dispute within seven 7 days of receipt of the notice. The matter will be referred for negotiation between authorized representative of State Bank of India and branches the Recipient.

The matter shall then be resolved between them and the agreed course of action documented within a further period of 15 days. In case any dispute between the Parties, does not settle by negotiation in the manner as mentioned above, the same shall be resolved exclusively by arbitration and such dispute may be submitted by either party for arbitration within 20 days of the state of negotiations. Arbitration shall be held in London and conducted in accordance with the provisions of laws applicable for arbitration in England and Wales.

The Arbitration proceedings shall be presided by the sole arbitrator appointed by State Bank of India. Applicable Law and Jurisdiction of Court Any disputes between State Bank of India and the Recipient arising out of the RFP shall be governed in accordance with the Laws of England for the time being in force.

Execution of SLA The selected bidder shall execute a Service Level Agreement, which would include all the services and terms and conditions of the services to be extended as detailed herein and any other conditions as may be prescribed by the Bank. The contract shall be executed by the authorized signatory of the selected bidder.

RFP State Bank of India, UK Operations UK BRANCH has submitted a draft Regulatory Business State to PRA and is in the process of submitting the Application for Authorisation to regulators in July Project Scope A summary description of the envisaged scope is enumerated as under. However, State Bank of India reserves its right to change the scope of the RFP considering the size and variety of the requirements and the changing business conditions.

The subsidiary will be set up by initially carving out the retail business of SBI UK. UK Branch of SBI UK will continue to function separately. A copy of the latest Regulatory Business Plan RBP is available for the reference of interested Consultants. The Consultant shall be required to undertake to perform all such tasks, render requisite services and make available such resources as may be required for the successful completion of the entire assignment at no additional cost to the Bank.

The high level services as indicated in Para 3 will be covered under the scope bank this RFP. Transfer of assets Tax Advice including detailing the consequences of transfer of assets and Tax Relief from branch to state 2. Compliance on Tax aspects Registration with HMRC for Corporation Tax, Ad-hoc Support during and in the first 3 months of formation of subsidiary 3. Capital Structure Advising on the capital structure of the subsidiary from Tax efficiency perspective, esp.

Project management Project Management Preparation of Implementation Plan, Timelines, Documents List setc. No Workstream Details 1. However, the Consultant may be expected to accompany SBI in its meetings with UK Regulators, if required.

Commercial Bid Evaluation Criteria: The Consultants are required to provide the commercials Pricing based on assumption that the Consultant shall prepare the documents and policies and the Bank shall review the documents and policies. Quotes are needed for both the streams separately, preferably in the following format. For example, SBI reserves the right to choose a consultant only for VAT and Transfer Pricing and WHT Treaty alone.

The questionnaire is divided into the following sections: Services issues and technical capabilities. Please give their name, title, address and location, telephone number, fax number and e-mail address. Please set out any key skills or employee dependencies and the availability of replacement skills in those areas.

Please explain the organisational and management structure of your organisation including an organogram of your executive management and the roles and responsibilities of the management teams involved india relation to the services in the RFP. Please provide details of size and scale of these services.

Please categorise these risks according to whether they are risks for State Bank of India, for you, or risks that are to be shared jointly. If they are shared with others, please describe which staff would be shared and how this would work.

Please indicate whether these off-shoring services would be provided by you or by a third party and whether new or existing relationships would be used. Please confirm that the off-shoring service levels are at least equivalent to those in the UK. Please confirm that the service can bank provided during UK working hours. Do you have any limit on the type of cover you would offer at different times of day?

Where would they be located? Interested firms can submit their technical and commercial proposals in two separate sealed envelopes by Nov to Chief Risk Officer, State Bank of India, 15 King Street, London EC2V 8EA. Please include following details in the proposals: Technical proposal Firm's background and expertise branches providing SMCR preparation and implementation support to local as well as foreign banks. Suggested approach for supporting the bank in line with the scope for SMCR preparation and implementation outlined in Annexure-I.

It should be a comprehensive approach covering all aspects of SMCR preparation and implementation, including legal matters. Please submit only one option with all inclusive fixed fee, without any variations. SMCR Steering Group would comprise of Bank officials and members of professional firm. Professional firm to offer its Subject Matter Experts in the following areas: Regulatory Change and Compliance Corporate Governance Legal matters relevant to implementation of SMCR including Employment law, Remuneration code, etc.

Nov onwards 2 Gap Analysis Outlining the requirements for SMCR and ascertaining gaps in each area with respect to Bank's current governance arrangements, including: Aligning code of conduct and individual accountability to relevant policies and processes. Fit and proper Assessment Criminal Records checks, Regulatory reference, etc. Management responsibilities map, SoR Matrix and SoR forms, Handover documents, Cover arrangements, Performance appraisal process, Remuneration process, Recruitment process, Employment contracts, Training and support arrangements, Management information and monitoring processes Processes for india of individuals - documentation, training, support and on-going monitoring Conduct Rules Framework: Trouble logging in close.

Java Runtime JRE 1. Regular Saver goal calculator. Regular Saver Goal Calculator close. Please use as a guide only. These returns are not guaranteed. You may receive more or less than this amount. Interest is calculated gross. As the Jumbo Junior Regular Saver account interest rate is variable, this could change in the future.

In the event that the rate does change, the initial planner output will differ from the account maturity payment. View Online Banking Demos. State Bank of India SBI UK is authorized and regulated by Reserve Bank of India and Prudential Regulation Authority.

Subject to regulation by the Financial Conduct Authority FCA and limited regulation by Prudential Regulation Authority. SBI UK is entered on the Financial Services Register and its register number is SBI UK is registered in England and Wales registered no: Forexbranch no: BR as an overseas company, with a registered office at King Street, London EC2V 8EA.

For further information please visit www. Gross is a contractual rate payable before deduction of income tax at rate specified by law. Please tick here to get daily exchange rate alerts. Please tick here to get updates from SBI about any other products and services offered by SBI in UK.

State Bank of India, UK is inviting AMC Annual Maintenance Bank tenders to bid for Fire Alarm System at our corporate office building at 15 King Street, London, EC2V 8EA. AMC should include all Periodic Services 2 Biannual Full Fire Drills Weekly Fire bell testing on any call points. State Bank of India, UK is inviting AMC Annual Maintenance Contract tenders to bid for Passenger Lifts maintenance at our corporate office building at 15 King Street, London, EC2V 8EA. Tender for Telephone System Annual Maintenance Contract.

State Bank of India, UK is inviting service providers to apply for a tender process on an Annual Maintenance Contract with regard to the Mitel Telephone System at the following State Bank of India locations:.

Mitel Bank Access Point Hardware Mitel MXE Hardware Mitel ASU II Hardware. Mitel Mitel e Mitel Mitel Mitel HPe Proliant DL Gen 9 HPe Proliant DL60 Gen 9 HPe Store Easy HPe Proliant Gen 9. STATE BANK OF INDIA Mitel IP Telephone System with 10 handsets:. State Bank of State East Ham High Street North East Ham E6 1HZ.

Therefore you are invited to submit a NEW tender for the supply and installation of a Mitel Telephone System that consists of and meets the following main requirements:. Tenders will be evaluated based on the 'Code of Procedures for Single Stage Selective Tendering ' Section 6, Alternative 2. Mr Krishnan Kutty State Bank of India 3rd Floor 15 King Street London EC2V 8EA. Please note the Client's specific india for tender forex these will be opened in two parts and should be submitted in two separate envelopes marked 'Part A' and 'Part B'.

STATE BANK OF INDIA Video Conferencing Unit:. The State Bank of India is inviting quotations for a New Video Conferencing System for our location at Hasilwood House. State Bank of India, 5 th floor Hasilwood House 60 Bishopsgate, London EC2V 4AW. Commercial Grade 55" TV Commercial Grade camera Laptop connectivity for sharing presentations.

STATE BANK OF INDIA RETAIL BRANCH TENDER:. Therefore you are invited to submit a NEW tender with two separate quotations for the following works:. Remove existing door and frame to cupboard below stairs and make good wall. To remove the existing temporary brushed aluminium, manual opening, shopfront glazed door and put aside for storage. All works are to be carried out of hours in evenings and india in order to avoid interference with the day to day operations of the Branch. Original Glazed Door NBS Spec.

Doors Scope of Works. Harrow - Unit 1, St Anns Road, Harrow, Middlesex, HA1 1AP. Hygeia Harrow 3rd floor, Hygeia House, College Road, Harrow, Middlesex, HA1 1 BE.

State Bank of India 15 King Street London EC2V 8EA United Kingdom. RFP means the "Current RFP Document". The RFP document contains statements derived from information that is believed to be reliable at the date obtained but does not purport to provide all of the information that may be necessary or desirable to enable an intending contracting party to determine whether or not to enter into a contract or arrangement with State Bank of India in relation to the provision of services.

The RFP document is intended solely for the information of the party to whom it is issued " the Recipient " or " the Respondent " and no other person or organisation. The RFP document together with all other information, materials, specifications or other documents provided by State Bank of India shall be treated at all times as confidential by the Recipient and is not to be reproduced, transmitted, or made available bank the Recipient to any other party. Subject to any law to the contrary, and to the maximum extent permitted by law, State Bank of India and its officers, employees, contractors, agents, and advisers disclaim all liability from any loss or damage whether foreseeable or not suffered by any person acting on or refraining from acting because of any information, including forecasts, statements, estimates, or projections contained in this RFP document or conduct ancillary to it whether or not the loss or damage arises in connection with any negligence, omission, default, lack of care or misrepresentation on the part of State Bank of India or any of branches officers, employees, contractors, agents, or advisers.

The Recipient must conduct its own investigation and analysis regarding any information contained in the RFP document and the meaning and impact of that information. Each Recipient acknowledges and accepts that State Bank of India may, in its absolute discretion, apply whatever criteria it deems appropriate in the selection of organisations, not limited to those selection criteria set out in this RFP document.

Each Recipient should notify State Bank of India of any error, omission, or discrepancy found in this RFP document but not later than two business days prior to the due date for lodgement of RFPs. A Recipient will, by responding to State Bank of India RFP, be deemed to have accepted the terms as stated above from Para 1 through Para RFP Response may be received by the officials indicated below not later than 5: State Bank of India.

All separate copies of RFP and attachments must be provided in a sealed envelope or sachet. Registration will be effected upon State Bank of India receiving the RFP response in the above manner Para RFPs lodged after the deadline for lodgement of RFPs may be registered by State Bank of India and may be considered and evaluated by the evaluation team at the absolute discretion of State Bank of India. RFPs will remain valid and open for evaluation according to their terms for a period of at least six 6 months from the RFP closing date.

Any further questions or queries relating to the RFP, technical or otherwise, must be in writing only and should be addressed forex email to:. The Technical bids of the respondents shall be evaluated based on the criteria mentioned in point no. The following is an indicative timeframe for the overall selection process. Acceptance of Work Order: The Recipient and State Bank of India shall endeavour their state to amicably settle all disputes arising out of or in connection with the RFP in the following manner:.

Any disputes between State Bank of India and the Recipient arising out of the RFP shall be governed in accordance with the Laws of England for the time being in force. The selected bidder shall execute a Service Level Agreement, which would include all the services and terms and conditions of the services to be extended as detailed herein and any other conditions as may be prescribed by the Bank. State Bank of India, UK Operations UK BRANCH has submitted a draft Regulatory Business Plan to PRA and is in the process of submitting the Application for Authorisation to regulators in July A summary description of the envisaged scope is enumerated as under.

Tax Advice including detailing the consequences of transfer of assets and Tax Relief from branch to subsidiary. Registration with HMRC for Corporation Tax, Ad-hoc Support during and in the first 3 months of formation of subsidiary. Advising on the capital structure of the subsidiary from Tax efficiency perspective, esp.

Project Management Preparation of Implementation Plan, Timelines, Documents List setc. The Consultant is not expected to travel outside London. Technical Bid Evaluation Criteria.

Good understanding of SBI requirements in the proposal including, the impact of various aspects. Please give details of your staff numbers, skills, duties and locations those who will be associated with the proposed work. Please provide details of the levels and kinds of insurance held by your organisation and describe which services and areas such insurance would apply.

REQUEST FOR PROPOSAL RFP For Selection of Legal or Consultancy firm forex assisting us in all Legal Activities related to setting up a banking subsidiary in UK. For more details please refer to the full RFP.

For any clarifications, please contact Mr David Attree, Chief Risk Officer, State Bank of India, 15 King Street, London EC2V 8EA. Scope for SMCR Preparation and Implementation Support. Weekly meetings to review the progress of project plan, determining action points and reporting to Bank's Senior Management.

Outlining the requirements for SMCR and ascertaining gaps in each area with respect to Bank's current governance arrangements, including: Development of comprehensive project plan with specific action points and timelines. Training session for Senior Management Training sessions for Certified Persons Training sessions for all employees on conduct rules Development of on-going Training programme for SM, CP and all employees on conduct rules.

Development and testing of SMCR implementation framework in line with the Project Plan. Any other work relevant to implementation of SMCR. Professional firm to facilitate implementation of Branches and review the arrangements to ensure that the bank has fit for purpose policies and procedures to independently manage and monitor SMCR implementation on an on-going basis.

Sometimes they are the result of thinking and behavior that has worked (we think) in the past, so why change it now.

The first one happened when he was in 6th grade and forced to he moved to Vacaville from New Jersey.

The society is responsible for the suffering of such innocents who were convicted in wrong to begin with.

Even before the new Army vision took shape and the Army began its transformation efforts, the fast-paced, nonlinear operational concepts now associated with the Objective Force were emerging.