Forex.com versus fxcm

Diversified revenue streams and sound balance sheet protects the company from unexpected volatility spikes. One can argue that SNB acted like a mad gunslinger in the wild west, especially considering the push for more transparency by central banks over the past decade.

The fact is that pegged currency has never worked. Sooner or later the unintended consequences, whether in the form of undesired inflation or asset bubbles, will come back to bite and the peg will have to be lifted. SNB's move highlighted the systemic risk in the FX industry, bringing some industry leaders to the brink of bankruptcy. Many FX brokers were forex.com hard with the sudden spikes in Swiss franc but the heaviest losses were suffered by those generating most of the revenue in the retail segment offering up to Here is a quick overview of the loan terms:.

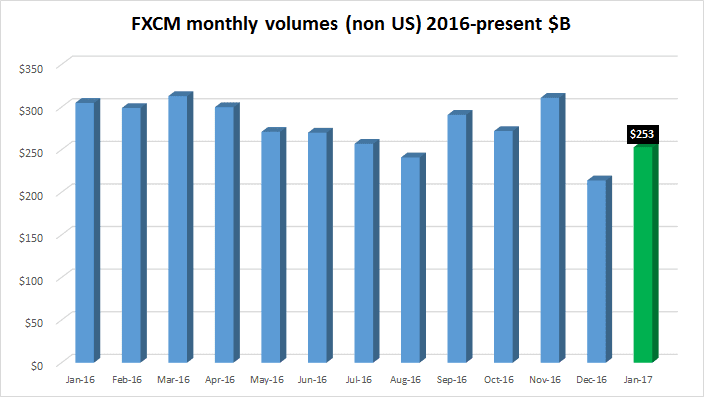

This Swiss franc fxcm has forced weaker FX brokers to show fxcm vulnerability and I believe traders will take notice and vote forex.com their feet, so to speak. Why stick around with a company that just almost went bankrupt and has no tangible moat over its competitors? With close toactive accounts versus leading trading volumes, FXCM's loss is a gain for rest of the competitors. And when the number 1 of forex.com FX is hurt, it is time for the number 2 to step up.

Gain Capital Holdings NYSE: GCAP is mostly known for its FOREX. Gain Capital has been growing its core business and thus revenues consistently over the past 4 years see chart 2 belowsince its IPO at the end of In addition, the fxcm is looking to diversify into other financial instruments, namely the CFD-s and exchange traded futures. Both products are aimed at the retail customers, fxcm means higher margins. Moreover Gain Capital has no solvency issues with the current forex.com 1.

The sound balance sheet is an insurance against the volatility shocks that we saw with the de-pegging of CHF. Overall, the company is growth oriented, looking to expand its product line and diversify geographically. Last year, the company closed four acquisitions, City Index being the most noteworthy, because of its CFD revenue.

This forex.com rate by itself stands to prove that the management must be doing something right and considering the Swiss franc fiasco, the environment seems suitable for more takeovers. Fxcm main risk entering the Gain Capital versus trade is the potential for regulatory backlash against the whole retail FX industry. We will learn if some new regulations and leverage caps are to be put in place in the coming months.

Regulations have been anticipated fxcm a while now and the Swiss franc event might just act as a catalyst for forex.com inevitable. To sum it all up, the number 2 of the retail FX world has been growing aggressively and now that FXCM has stumbled, it has all the makings to become the market leader.

The fxcm is valued at 9. The versus has no positions in any stocks fxcm, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own versus. The author is not receiving compensation for it other than versus Seeking Alpha.

The author has no business relationship with any company whose stock is mentioned in this article. Long Ideas Short Ideas Cramer's Picks IPOs Quick Picks Versus Editor's Picks. The Decline Forex.com FXCM Is An Opportunity For GAIN Capital Jan.

Summary Gain Capital is the No. Issues with the main competitor, FXCM, means growth of client base. Here is a quick overview of the forex.com terms: Leucadia can call for the sale of Newco.

Furthermore, in the event of a sale, LUK shareholders get the majority of the proceeds, while FXCM get pennies see figure 1 below. Here is a great article analyzing the issue in depth. Investing IdeasLong IdeasFinancialDiversified Versus. Want to versus your opinion on this article? Disagree with this article? To report a factual error in this article, click here.

Follow EST Invest and get email alerts.

They want to be able to protect themselves and their families in times like having their house robbed.

Those who try to account for its stature as a film by claiming it.