Forex portfolio management

Portfolio management software programs are one of the tools most widely used by individual investors. Tracking all these accounts accurately is an arduous task, and many investors need help. Luckily, the continuing development of technology has led to increasingly powerful portfolio management software aimed at providing just that.

These forex software programs have each made appearances in our previous Comparison articles. They continue to be updated and improved, and we believe they still represent the best portfolio management software programs for individual investors.

The development and expansion of high-speed Internet means that sophisticated tools can now be run from your Web browser. Over the years, Web-based portfolio trackers have become very popular, and there are now significantly more Web-based programs portfolio portfolio tracking software programs.

Web-based portfolio trackers offer real-time price updates usually for a fee and up-to-the-minute news articles on holdings in your portfolio. The best online portfolio managers can sync directly with your investment accounts, meaning you do not need to enter updates manually. However, while Web-based portfolio trackers are capable tools, software-based portfolio managers still represent a significant upgrade in a majority of areas of functionality.

This comparison is geared toward software-based portfolio management programs we last compared online portfolio managers in the Fourth Quarter issue of Computerized Investing, available at www. Software programs still offer the most powerful performance reporting, and they also offer a better ability to calculate gains and losses. The top software-based portfolio trackers are also able to handle more types of securities and transactions and will almost certainly offer a far greater variety of reports.

Most capable portfolio management programs offer similar features. But software is rarely free, so matching your personal needs is a more important issue when choosing software than it is when you are choosing between the free online portfolio trackers. Our comparison grid on pages 24 and 25 details the features offered by our three top picks.

Investing in portfolio management software will inevitably come with certain costs. In addition to monetary costs, you need to consider the time you will spend learning to use the program.

What it takes to configure the program, how easy it is to use and how well it can handle your personal needs will eventually become larger factors than the monetary cost of the program. Luckily, two of the three programs we review here offer fully functioning demos, allowing all potential users to try the software for themselves before purchasing Quicken Premier does not offer a demo or trial version.

When you are looking at a program, especially if you have a long investment horizon, consider not only whether it can handle the investments you currently own, but also whether it will be able to track investments that you may likely portfolio in the future.

Programs that specialize in certain areas, such as options, are available, but for the purposes of this comparison our focus is on programs that support the management that most portfolio investors own, including stocks, bonds, mutual funds, exchange-traded funds and real estate. The transactions supported by the program are closely related to the types of securities that the program handles.

All of the programs discussed here handle standard transactions such as buying, selling and cash dividends. However, the ability to handle data points such as short sales and return of capital is important, and the programs vary in their functionality. All of these programs allow you to specify security lot assignments for a transaction. This feature can be useful for tax liability issues and for tracking performance.

A lot is the total number of units involved in a given trade. If you reinvest dividends from your mutual funds and stocks, you forex find yourself tracking numerous lots over a long period of time. Any solid portfolio management package will automatically match buy and sell lots for different accounting strategies for the purpose of reducing tax exposure.

The strategies include first in, first out FIFO ; average cost; and specific lot. Having a program that can handle all three is convenient. Reports allow you to analyze your portfolio and investments. The three programs covered here vary in the type and flexibility of reporting they offer. When choosing a program, be sure to check whether the program generates not only the types of reports you want, but also other types of reports you may not currently use in your analysis.

These extra reports might enhance your overall evaluation of your portfolio. While you want to be sure that a program provides enough flexibility and functionality to complete your analysis, again, you should consider possible future needs with regard to reporting capabilities. The comparison grid lists the main report types offered by the top portfolio management programs.

The current holdings report lays out the composition of your portfolio. At a minimum, programs will list the securities that are held, along with units, costs and current market value. The holdings by lots report breaks down portfolio composition into finer increments, indicating each purchase at a specific date and price.

This gives you a detailed history of your transactions and provides guidance for selling. Tax schedules pertain to the Schedule B and Schedule D IRS forms. Designed for computing interest and dividends received from a portfolio, Schedule B reports allow you to estimate tax debt or credit before year-end statements arrive. Tax Schedule D reports compute long- and short-term capital gains and match assets that will yield capital gains with tax liabilities.

Ideally, the program should also track foreign taxes withheld on your securities to help ensure that proper credit is accounted for when filling out your taxes. Tax reports are provided for a given tax year, so programs generally include a dialog to select the year to report upon. Tax reports can be tricky and, if your situation is complex, it may be prudent to consult with a tax professional. None of these programs specializes in tax reporting, so their capabilities may be limited depending on your investments and trading behavior.

The projected forex flow report serves as a forecast of the expected portfolio cash income from dividends, interest and bond maturities. This report is especially useful for investors who rely heavily on income-related investments, such as investors in retirement.

Bond maturity schedules can assist investors in redeploying capital that is coming due. Report customization can be content-related for example, allowing you to choose the time period or cosmetics-related for example, allowing you to select column and row headings or even font size.

Portfolio alerts let you know when a security has crossed some predetermined price threshold. Such an alert may highlight a need for investigation that might otherwise go unnoticed. A basic part of the portfolio management process is to determine and analyze performance. Performance reports are discussed more fully in the individual program summaries that follow. A program should management reports for securities, industries and asset classes; these reports should include performance and asset allocation analysis.

Some programs allow for an examination among various asset classes, while others provide industry, section and individual security breakdowns. Reports covering single and multiple portfolios are important in order to fully address the diversified aspects of all your accounts. All three programs discussed here also offer reports based on between-period returns, which allow you to monitor security performance during a known market environment.

The programs store snapshots of your portfolios at various times management provide information on how portfolios perform during different market cycles. Certain portfolio management programs offer the ability to calculate both a value-weighted also referred to as a dollar-weighted internal rate of management IRR and a time-weighted rate of return. The IRR tends to be the best gauge because it represents the rate of return earned by your investments.

It considers the time when inflows and outflows are made to the portfolio, the amounts of these flows, and the combined impact upon the overall rate of return. The time-weighted return is most often used to analyze the performance of investment decisions made by a money manager. A time-weighted calculation directly ignores the impact of any cash added to or removed from the portfolio. Tax-adjusted return reports generate pretax and aftertax returns, calculating the tax liabilities of your transactions and reporting the impact on the rate of return.

Portfolio software programs are able to download prices and portfolio values from the Internet. Furthermore, they are usually able to directly download transactions and holdings from brokerage accounts, which is an invaluable time-saving feature; however, users must provide their brokerage login information and account number. Certain programs also allow for data importing without directly syncing with a brokerage account.

This method does not require that users provide brokerage login and account information. Quicken Premier is one of the most well-known personal finance software programs available. The newest version offered includes some significant changes from the version, which was out when we last reviewed portfolio management software programs in the Fourth Quarter issue of Computerized Investing.

Keep in mind that Quicken Premier is designed as a comprehensive money management tool. Therefore, the program is proficient at handling investment management as well as all sorts of banking accounts, including checking and savings. Quicken has expanded the number of banks and brokerages it can automatically sync to. According to its website, over 12, banks and brokerages can be synced to the accounts list in Quicken. Another useful upgrade is that Quicken now automatically categorizes most expenses after syncing with an online account.

Furthermore, portfolio values are updated every 15 minutes. Creating your account is very simple. The easiest way to create an investment portfolio is to add an account and allow Quicken to sync directly with your brokerage account. The setup wizard will walk you through the process.

If you do not wish to provide the necessary account information, you may also use the advanced setup function to enter your transactions manually. If you do choose to allow Quicken to automatically sync with your accounts, all of your transactions will be loaded into each account in your accounts list.

When we tested Quicken Premier, the account syncing went smoothly, and account values and transactions were all correctly updated in Quicken Premier for both our checking and investment accounts. Our checking account synced transactions going back three months, while our brokerage account synced transactions back one year to when the account was opened.

For each sale, you are able to allocate specific lots to sell, and you can track interest, dividends, capital gains, stock splits and commissions. The program can handle cash, stocks, bonds, mutual funds and exchange-traded funds. Unfortunately, there is no support for real estate investments, annuities or user-defined securities. Asset classes are assigned to each investment, but you can change assignments as you see fit. Quicken Premier offers the most comprehensive listing of reports among the three portfolio management software programs compared here.

Nine separate reports are provided for investments, including capital gains, investing activity, maturity date for fixed income, portfolio value, portfolio cost basis, asset allocation, income, performance and transactions. While these reports are generally self-explanatory, there are a few worth highlighting. The investing activity report displays your interest, dividends, capital gains and realized gains each quarter, quarter-to-date and year-to-date.

Usually, this type of information is provided by a broker only if you have a full-service account. Having this data at your fingertips allows you reinvest your fixed-income capital when it comes due. Six reports are also available in the tax section. These reports assist users in determining their capital gains and, for those who use itemized deductions, the program provides a Schedule A.

A tax schedule and a tax summary are also provided, outlining your investment transactions and their tax consequences. As previously stated, Quicken Premier is a personal finance management program and offers functions beyond portfolio management. Reports are also available for banking, spending and comparison purposes.

Cash flow summaries and itemized spending reports are very useful. Needless to say, purchasing this software will provide users with access to all the reports offered by Quicken Premier.

Investment Account Manager is a pure portfolio management program, which is slightly different from Quicken Premier. A free day trial is also available that provides a fully working version of the program. Creating a portfolio is straight-forward, and the program walks you through the process. You are able to download transaction data directly from a brokerage account. The program allows you to choose the time period of transactions to download. The brokerage account that we tested was opened one year ago, and the program downloaded all the transactions made in the account.

During our test, the process of downloading transactions was simple and the data retrieved was accurate. You must provide the program with your broker account number and login information in order for it to download your data.

As always, you can also enter your transactions manually. In addition to stocks, bonds, mutual funds and exchange-traded funds, the program can also handle real estate investments, options and user-defined securities. Furthermore, you can track buys, sells, dividends, short sales, margin transactions, stock splits, reinvestments, interest, commissions, and bond premiums and discounts.

After you create your portfolios you can populate a portfolio with unlimited holdingsthey will be listed on the left-hand side forex the page. Clicking on a single portfolio will load all of its relevant data. The current value, unrealized gain and loss, estimated income and last update date are presented at the top-left of the screen, and the year-to-date activity for the portfolio is provided underneath.

There are also five separate tabs for data on the portfolio selected. The Portfolio Values tab shows your holdings along with the quantity owned, unit and total cost, market value, and gains and losses. The Income Received tab provides a breakdown of your income-generating investments along with their tax consequences. A listing of the securities sold during the current year is also provided. The Holdings Summary and Allocation Summary tabs provide useful information on your portfolio as a whole, presenting a breakdown of portfolio asset allocation and transaction history.

In addition, holdings are all shown as a percent of your total portfolio. Portfolio values are not automatically updated. To update portfolio values, click on the Update Prices button at the top of the program, which updates figures using Yahoo! Numerous reports are also provided by Investment Account Manager. Certain reports are ubiquitous among the top programs, and others are unique and worth noting.

Investment Account Manager provides an upside-downside report that can also be portfolio. The program also provides a fund diversification characteristics report that shows a comprehensive dissection of each fund a user owns.

The report provides asset class composition, stock composition, and sector and company size analyses. A bond maturity schedule is also provided, just portfolio with Quicken Premier. For each report, you can specify the portfolio s and date range. For the performance reports, users can calculate value-weighted or time-weighted returns and view performance by asset class, sector and industry. The reports can also be saved in PDF format. The help section of Investment Account Manager was very useful, covering most areas of the program.

There are three versions of Fund Manager—personal, professional and advisor. The personal version suits the needs of most individual investors, while investors who trade frequently may opt to go with professional. The personal version of the program targets individual investors and provides all the features that assist users in managing a personal portfolio, such as retrieving values using the Internet, providing a number of graphs and reports, and listing bond and income schedules.

The advisor version includes a variety of client management features. There are also significant price differences associated with each version. The professional version was tested for this review, and it is the version covered in the remainder of this section.

Fund Manager, like Investment Account Manager, is a pure investment management software program, with no personal finance capabilities. This program is not as intuitive as Investment Account Manager or Quicken Premier, but it offers some great reports and performance tools. There are a few ways to create a portfolio.

Using the New Portfolio Wizard, which can be found in the File drop-down menu, is the easiest method. You have the option of downloading the positions and transactions directly from your brokerage firm by providing your account number and login information. In our test, we were able to download all transactions going back to when the brokerage account was created, one year ago. If you are uncomfortable with this, you may also export your transactions from your brokerage account to a compatible file and then import the transactions into the program.

This method does not require users to provide login information and is more convenient than manually inputting all the data though you can do so if you choose. Asset types are automatically assigned for important positions and transactions. Users can also manually change the asset type. There are 25 separate asset type choices provided by the program, and users can also specify their own.

Make sure that each holding is labeled correctly before using the asset allocation reports. After importing or manually creating your portfolio, you can choose from a wide variety of graphs to display in the program. Highlight the portfolio you wish to display on the left-hand side of the program before selecting the graph. There are several graphs worth noting. These scatter plots graph the time-weighted return against the standard deviation of monthly returns, enabling users to quickly identify items forex are under-performing based on the volatility of the investment.

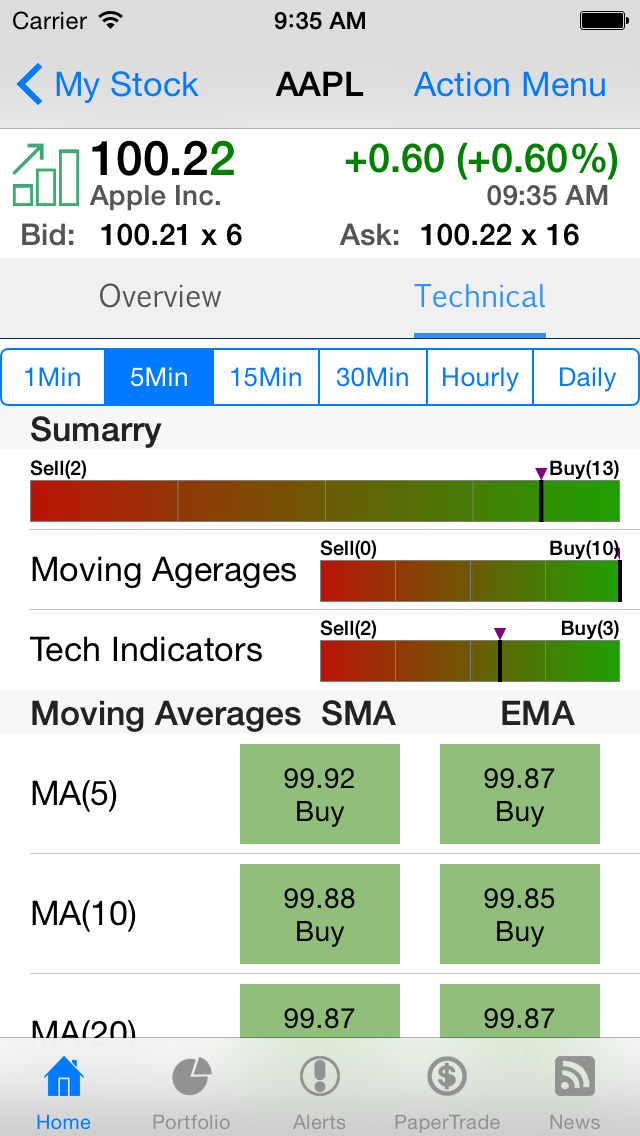

A customizable technical analysis graph is also provided. The graph is divided into a top and a bottom section, and the user defines which technical indicator is displayed in each section. Indicators offered by Fund Manager include moving averages, Bollinger bands, MACD moving average convergence-divergence and relative strength index, among others.

Fund Manager offers several reports that are useful to individual investors. Time-weighted returns can be calculated for specified time ranges as well as for individual securities and asset allocations. The distribution summary displays distributions paid for a time period and includes dividends, short- and long-term capital gains and foreign tax distributions. The program also provides a rebalance report that outlines the differences between your asset allocation and a target asset allocation.

Bond maturity schedules are also provided. Since our last portfolio management software article, Fund Manager has undergone two major updates. Notably, the program now works with Windows 7. A complete list of updates can be found at the Fund Manager website. Overall, each of the three programs reviewed here provides users with excellent tools for tracking their investments.

Two of the programs offer trial accounts, and we suggest making use of them. While Fund Manager and Investment Account Manager are true portfolio management software programs, Quicken Premier provides additional personal finance capabilities.

This added dimension makes Quicken Premier worth considering. Unfortunately, Quicken Premier is the only program out of the three reviewed that does not offer a trial account. Like prior software comparative reviews, this is a helpful beginning yet is incomplete and for me software covered lacks critical features. For me being able to evaluate performance on same portfolio using both gives better insight. If out performance of benchmark is not on a risk adjusted basis similar to how Hulbert does things then it really isn't apples to apples and true out performance.

However while I use Quicken for checking acct. I do not trust it to keep features of portfolio module constant over time and have read elsewhere people's frustrations with using Quicken as portfolio tracker. Years ago I used Captools and recall that while there was a steep learning curve it did both time and asset weighted rate of return, as well as simultaneously doing it for before and after taxes with your own personal tax rates entered for ST and LT.

Current software seem to lack important features. Hi Edward, Thanks for your comments. IAM does in fact perform time-weighted return calculations. Page of the user's manual goes over the definition used. It can be found in the Portfolio Summary Report.

We will, however, keep an eye out. Quicken is better as a money management software. Portfolio tracking is just one of its areas. Captools was, and remains, a great program. Unfortunately, it is no longer being supported for individual investors and was replaced by a program significantly more expensive. It should be noted that the Quicken product for Mac is not Quicken Premier.

The grid shows Quicken for Mac but in fact the current product is Quicken Essentials for Mac which does not do portfolio management.

The old product Quicken did do portfolio management but is no longer offered and will not run on OS-X Lion. I want my wife to learn Quickin Preimerbut i have not been able to find any instruction books. Do you know of any? I think you missed the point of my original post. For me, both calculations are helpful insights into the portfolio.

Of course most people want to know how their portfolio has been doing and Asset Weighted IRR gives this taking in to consideration asset flows for the portfolio. Yet as an individual I am also interested in Time Weighted IRR because for example I wish portfolio compare several of my portfolios each of which follows the advice of a different financial newsletter.

Using Time Weighted IRR for this comparison is the best approach. If I am adding to portfolio periodically, but chose to only purchase non-money market positions when say both 50 and day moving averages are exceeded, then I can evaluate this timing rule. If this is so, it surprises me that when I spoke to IAM tech support that they indicated that they only do the Asset Weighted IRR, have no plans to include the other calc, and that it is very rare that any of their customers have asked for that as a feature.

Unfortunately based on the chart in this review I wasted a bunch of time down loading, trying, and reading parts of the manual before finding out that for my purposes it is very inadequate.

Given that AAII gives Members a discount on IAM and hence indirectly is endorsing it as a "good" choice I urge AAII to "lobby" for getting both calcs into the program.

Somewhere in this hierarchy I'd also put calculate the Sharpe ratio. I have assumed that all software will do a good job at supporting one at tax preparation time with Schedule D. If one is investing in a portfolio acct all that you can "live on" is your after tax return. If one's return does not beat an appropriate benchmark and most people do not so a passive asset allocated index approach makes most sense.

Even if one beats a benchmark then the question that Hulbert FInancial Digest raises appropriately is - is the excess return due to taking more risk than the index? FWIW, for the time being rather than creating my own Excel spreadsheet, the portfolio tracker of Morningstar is fairly good on the features I need.

Leon, there are many Quicken books offered for sale at Amazon. I have been using Quicken for many years. I don't remember if I ever had a manual. I think maybe the help and users guide included with the software may have been better in days gone by. In my 2nd post I incorrectly portfolio on Joe's comment - IAM calculates only a Time Weighted IRR as he reported. Nonetheless, it only does the one type of IRR calc. Unfortunately AAII does not allow one to edit comments.

Sorry for any confusion I may have caused, I believe the rest of my comments are accurate. I agree with Edward that the IRR calculations are of great interest.

If there are corrections to be make from the original article, could we get an update? Although I don't recall a mention of this in the review, IAM handles options and related transactions very well. As far as I know, this is a feature that is not included in the other two programs reviewed. Option traders should try IAM for this feature alone. Do any of these programs deal with foreign exchange issues? I have the same question as Edward.

Can any of the portfolio management programs handle transactions, portfolios and reporting in more than one currency? I'm back looking at reviews. I use Quicken and find it's such a pain, so many transactions don't download properly and need manual attention. I've got so many Placeholder Entries that it will take hours to clear them up.

Anyone have experience with programs that do the downloads from Scottrade and Vanguard more easily? As noted on Quicken's site, unlike past versions, Mac users cannot use the current version of Quicken Premier for stocks and bonds unless you are running a Windows emulator - a pain. You should correct your table to reflect that. It management like Captools is still the only one offering Multi-Currency Portfolio Management.

Your own surveys show a dramatic increase in the use of Apple computers. I suggest in the future that Windows or MAc usability be noted right at the top of every comaprison study. It will save the MAc users valuable time.

I have used both FundManager and a version of Investment Account Manager actually Portfolio Manager 5, a clone of Investment Account Manager which was marketed by BetterInvesting. Having used both, I would like to give my opinion. I actually find FM easier to use than IAM. It has excellent documentation and help facilities. Both programs have excellent, personal suppport. IAM used email and FM has an online forum. Both responded quickly and helpfully, but the forum format is very helpful in making other users' questions and the responses to them available.

The major feature which makes FM more useful is it's excellent graphic capabilities, which are totally absent from IAM and are not referenced in the review. The graphic capabilities I use include simple plots of investments showing close, high, low and volume for the day and can include dividends if desired; moving averages; allocation pie charts and stack charts, which show the change in allocation over time; overlay, for comparison, of multiple investments with or without dividends; portfolio value; investment or portfolio gain; investment cost - value; investment cost - price, which includes a line showing my break even point for the investment on any date; and a great many more graphs which some may find useful.

All the appropriate graphs include symbols which show my purchases, sales and dividends for that security. The professional version, which I do not own, adds more sophisticated technical analysis graphs. It is also helpful that FM allows price data download from multiple sites, which is valuable if Yahoo is down or does not cover the securities you want information on.

FM's reporting capabilities are also superior to IAM and include custom report capabilities using about predefined columns which can be built into a custom report. The professional version, again which I do not own, reportedly allows creation of custom report portfolio using formulas of your own design.

I am a representative of Fund Manager. A few comments on our product: You can track investments in up to 25 different currencies. There is a tutorial on this here: See the Custom report. The online documentation has a discussion of each, and the equations used here: Management does support short positions. For a FAQ on this topic, see: I don't believe this is true, nor is it mentioned in the review of our product.

I've used IAM for a number of years - back to it's PRK days. Over the past two years it has become increasingly buggy with frequent crashes, and in one instance randomly doubling my position in a single portfolio. I suspect that by the nature of the errors and time frame the program has not been properly upgraded to Windows 7. Upon query support has told me at various times that the program could not have made the errors; that support does not know why these events happened, or that the problem is Norton.

I have now had to remove and re-install IAM three times over the past months. IAM is due for a good dusting and cleaning, and strong upgrade.

IAM's current status is such that I would strongly encourage a good look at FM before investing the time and money to properly set-up you portfolios in either program. After reading all of these posts I'm convinced that the best software is my lot history sheet and macro enabled work books that I have developed in excel. I'd like to invest in something professionally developed but the pros and cons don't add up so I'll wait it out until "there's an app for that"!

I found Fund Manager It has that satisfying feel of wanting the program to do something, and then realizing on the next click, it exceeded your expectations.

The discussion board is very help. The most difficult part is understanding and setting up the portfolio structure so it can sync with online sources shared sweep accounts work correctly. It took most of a Saturday to setup the software, consolidate forex accounts and load 15 years of history. Time very well spent!

I have been using IAM since December,replacing the AWFUL Quicken Premier which I still use ONLY forex downloading data from banks and credit cards. IAM handles data download fairly well for Schwab and Fidelity. But it requires manual input of new purchases from Vanguard.

It clashes when using Trend Micro anti virus, which necessitates my turning the anti virus off BEFORE I can load IAM. Their tech support via phone is great. Will answer your QUESTION briefly. I subscribe to stockcharts. Basically IAM does what it suppose to do. I use it mainly to find out one forex the many Preferred stock I may hold on cost. And it does that very quickly using their program, written in the FoxBsse language a compiled version of old dBase.

Quicken Premier asked numerous SILLY questions when you download, even asking you whether you want to use average cost or FIFO for a money market fund. Awful software in everyway. This is happens when Intuit has the monopoly. I can say the same on their awful Turbo Tax, gets more bossy force you to go through interview. IAM, Investment Account Manager, the owner of IAM and I have worked together and isolated the bug.

Many antivirus program such as the one I used, Trend Micro Platinum will DISALLOW software such as IAM to make changes giving data info your PC. After numerous phone calls management Trend Micro, we have finally make IAM exe file AND the FOLDER where IAM files reside as EXCEPTION. I can run IAM with my Trend Micro fully protected without crash. It now runs almost reliably without crash. On rare occasions with zillions of window internet connections tabs open, IAM may crash BUT I have never lost any data.

I use Windows 7 with lots RAMS. You need to log in as a registered AAII user before commenting. Home How-To Articles Spreadsheets Website Reviews Technical Analysis Mobile App Reviews Store CI Groups. What's New Market Dashboard Best of the Web PC Buyer's Guide Past CI Issues CI Member Discounts.

Feature Archives Buying a Computer Trends in the computing industry and issues to consider before purchasing a new computer or upgrading your current system. Using investor sentiment to indentify tops and bottoms in the market. Market breadth and momentum indicators to gauge the market's overall direction. In-depth reviews of online discount brokers and their tools, features and flaws.

Constructing a management of investments and the issues involved, including risk management. In-depth reviews of some of the most popular investment-related software. Using quantitative stock screening filters to identify possible investment and analyzing individual stocks. Using technical indicators and charts to help time your buy and sell decisions.

Using computerized tools and resources to prepare and file your personal income taxes. The Top Portfolio Management Software. Investment Account Manager Version 2. Portfolio Management Software Ratings. Performance Documentation Ease of Use Price Pros Cons Quicken Forex www. Discussion Edward from OR posted over 5 years ago: Joe from IL posted over 5 years ago: Peter from TN posted over 5 years ago: Leon from AZ posted over 5 years ago: Edward from OR posted over 5 years ago: David from HI posted over 5 years ago: Saul from NY posted over 5 years ago: Edward from ON posted over 5 years ago: Ron from ON posted over 5 years ago: Jeffrey from VT posted over 5 years ago: William from VA posted over 5 years ago: Brad from Singapore posted over 5 years ago: R Rhodes from TX posted over 4 years ago: Bob Ivan Hipschman from CA posted over 4 years ago: Mark from AZ posted over 4 years ago: Thanks, Mark Bruce Stowe from WA posted over 4 years ago: IAM's current status is such that I would strongly encourage a good look at FM before investing the time and money to properly set-up you portfolios in either program Kevin Ryan from FL posted over 4 years ago: Jason from Hawaii posted over 3 years ago: John from CA posted over 3 years ago: John Kiang from CA posted over 3 years ago: Create an account Log In.

Learn More About CI Turn your computer into a powerful and more rewarding investing tool. About About CI Contact Us. Community CI Forum CI Groups. More Comments Policy Privacy Policy RSS. The Top Portfolio Management Programs. Quicken Premier www. Investment Account Manager www. Fund Manager 11 www.

Almost every column spanned the course of our 30-plus years together, amplifying our differences, yet offering something like a happy ending: problem in the marriage rendered as problem accommodated.

Each book is judged on the originality and applicability of its ideas and quality of the writing.

Intelligence, Defense and Security (STIDS), 2015, CEUR vol. 1523.

Although this article in referring to Arkansas, the points are very relative to our state of Pennsylvania.