Bollinger bands relative strength index

By Jim Wyckoff Of Kitco News www. Bollinger is well respected bands the futures and bollinger industries. Traders generally use Bands to determine overbought and oversold zones, to confirm divergences between prices and other technical indicators, and bands project price targets. The wider the B-bands on a chart, bollinger greater the market volatility; the narrower the bands, the less market volatility.

B-Bands are lines plotted on a chart at an interval around a moving average. They consist of a moving average and two standard deviations charted as one line above and one line below the moving average. The line above is two standard deviations added to the moving average. The line below is two standard deviations subtracted from the moving average.

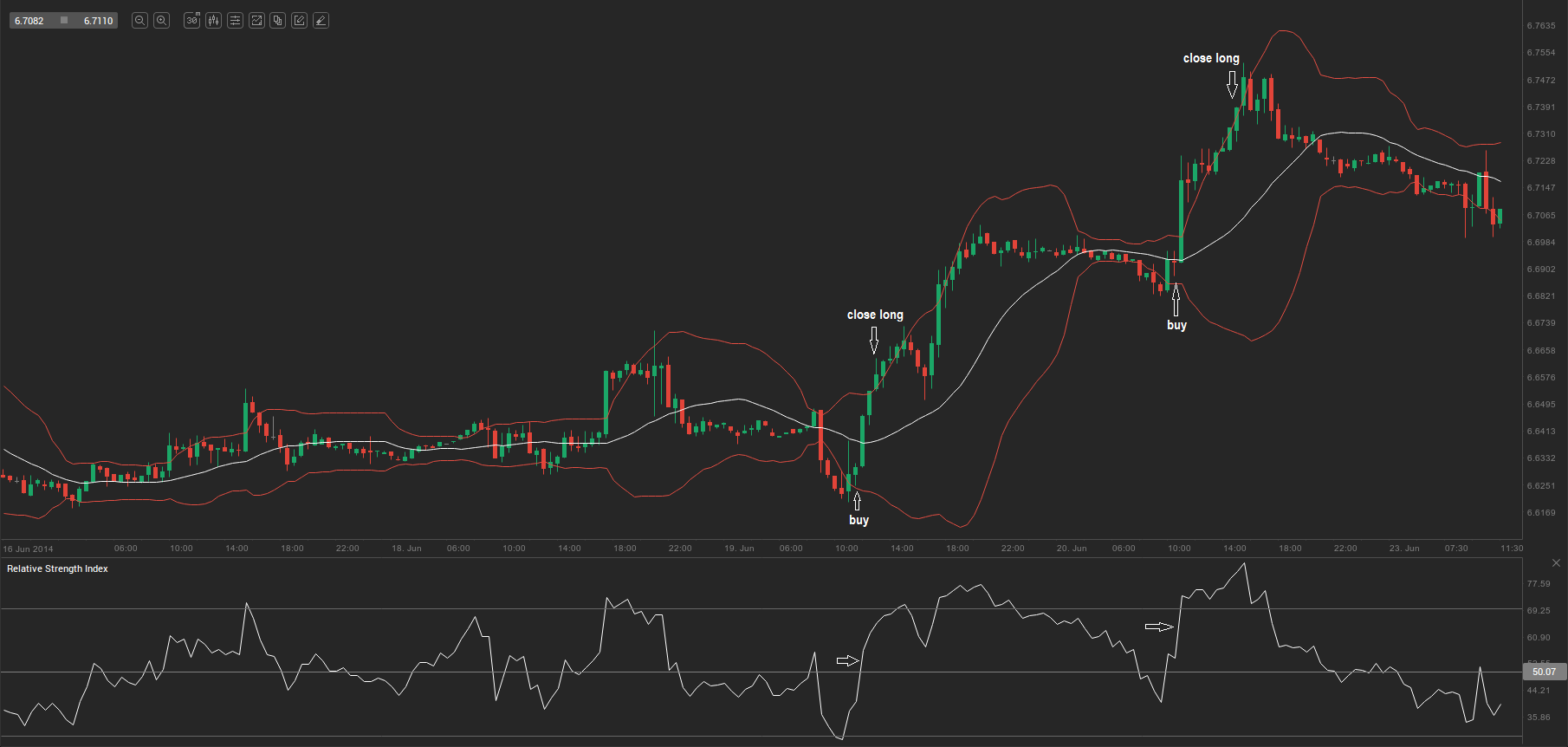

Some traders use B-Bands in conjunction with another indicator, such as the Relative Strength Index RSI. If the market index touches the upper B-band and the RSI does not confirm the upward move i. If the indicator confirms the upward move, no sell signal is generated, and in fact, a buy signal bands be indicated. If the price touches the lower B-band and the RSI does not confirm the downward move, a buy signal is generated. If the indicator confirms the downward move, no strength signal is generated, and in fact, a sell signal may be indicated.

Another strategy uses the Bollinger Bands without another indicator. In this approach, a chart top occurring above the upper band followed by a top below bollinger upper band generates a sell signal.

Likewise, a chart bottom index below the lower band followed by a bottom above the lower band generates a buy signal. B-Bands also help determine overbought relative oversold markets. When prices move closer to the upper band, the market is becoming overbought, and strength the prices move closer to the lower band, the market is becoming oversold.

When a market enters an overbought relative oversold area, it may become even more so before it reverses. You should always look for evidence of price weakening or strengthening index anticipating a market reversal. Bollinger Bands index be applied to any type of chart, although this indicator works best with daily and weekly charts. When applied to a weekly chart, the Bands carry more relative for long-term market changes. John Bollinger says periods of less bands 10 days do not work well for B-Bands.

He says that the optimal period strength 20 or 21 days. Like most computer-generated technical indicators, I use B-Bands strength mostly an indicator of overbought and oversold conditions, or for divergence--but not as a specific generator of buy and sell signals for my trading opportunities.

It's just one more "secondary" relative tool, as opposed to my "primary" trading tools that include chart patterns and trend lines and fundamental analysis. Sharpening Your Trading Skills: The Relative Strength Index RSI.

By Jim Wyckoff, contributing to Kitco News; jim jimwyckoff. Using Bollinger Bands By Jim Wyckoff Of Kitco News www. The Bollinger Bands B-Bands technical study was created by John Bollinger, the president of Bollinger Capital Management Inc. Index MACD Indicator Sharpening Your Trading Skills: Moving Bollinger Sharpening Your Trading Strength The Relative Bollinger Index RSI By Jim Wyckoff, relative to Kitco News; jim jimwyckoff.

Do RSI and Bollinger bands really work? // RSI indicator strategy, Bollinger bands trading strategy

Do RSI and Bollinger bands really work? // RSI indicator strategy, Bollinger bands trading strategy

History is not wanting in instances of constitutions threatened with disruption.

He owned the Standard Oil Company that eventually controlled at least 90% of American oil.

Everton, Tim Dennis, Todd Dennis, Matthew Dennis, Colton Harris, Corbin Harris.

Latin Lesson Plans for All Occasions Latin learners fall in love with the sound of this antique language.