Pair trading strategy stocks

In short, a quant combs through price ratios and mathematical relationships between companies or trading vehicles in order to divine profitable trading opportunities. During the s, a group of quants working for Morgan Stanley struck gold with a strategy called the pairs trade.

Institutional investors and proprietary trading desks at major investment banks have been using the technique ever since, and many have made a tidy profit with the strategy. Guide to Stock Picking Strategies. It is rarely in the best interest of investment trading and mutual fund managers to share profitable trading strategies with the public, so the pairs trade remained a secret of the pros and a few deft individuals until the advent of the pair.

Online trading opened the lid on real-time financial information and gave the novice access to all types of investment strategies. It didn't take long for the pairs trade to attract individual investors and small-time traders looking to trading their risk exposure to the movements of the broader market. What Is Pairs Trading? Pairs trading has trading potential to achieve profits through simple and relatively low-risk positions.

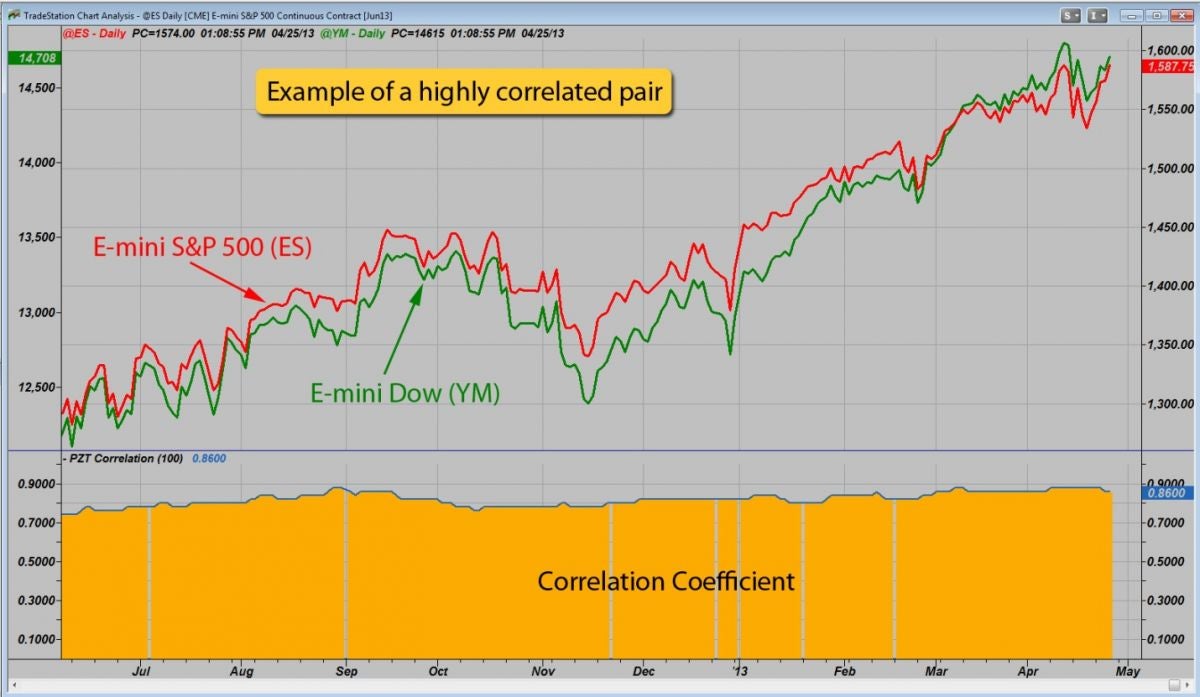

The pairs trade is market-neutralmeaning the direction of the strategy market does not affect its win or loss. The goal is to match two trading vehicles that are highly correlated, trading one long and the other short when the pair's price ratio diverges "x" number of standard deviations - "x" is optimized using historical data.

If the pair reverts to its mean trend, a profit is made on one or both of the positions. An Example Using Stocks Traders can use either fundamental or technical data to construct a pairs trading style. The first step in designing a pairs trade is finding two stocks that are highly correlated. Usually that means that the businesses are in the same industry or sub-sector, but not always. This simple price plot of the two indices demonstrates their correlation:. For our example, we will look at two businesses that are highly correlated: Since both are American auto manufacturers, their stocks tend to move together.

Below is a weekly chart of the price ratio between Ford and GM calculated by dividing Ford's stock price by GM's stock price.

This price ratio is sometimes called "relative performance" not to be confused with the relative strength indexsomething completely different. The center white line represents the mean price ratio over the past two years. The yellow and red lines represent one and two standard deviations from the mean ratio, respectively.

In the chart below, the potential for profit can be identified when the price ratio hits its first or second deviation. When these profitable divergences occur it is pair to take a long position in the underperformer and a short position in the overachiever. The revenue from the short sale can help cover the cost of the long position, making the pairs trade inexpensive to put on. As with all investments, there is a risk that the trades could move into the red, so it is important to determine optimized stop-loss points stocks implementing the pairs trade.

An Example Using Futures Contracts The pairs trading strategy works not only with stocks but also with currencies, commodities and even options. Stocks the futures market"mini" contracts - smaller-sized contracts that represent a fraction of the value of the full-size position - enable smaller investors to trade in futures.

A pairs trade in the futures market might involve an arbitrage between the futures contract and the cash position of a given index.

When the pair contract gets ahead of the cash position, a trader might try to profit by shorting the future and going long in the index tracking stock, expecting trading to come together at some point. Often the moves between an index or commodity and its futures contract are so tight that profits are left only for the fastest of traders - often using computers to automatically execute enormous positions at the blink of an eye.

An Example Using Options Option traders use calls and puts to hedge risks and exploit volatility or the lack thereof. A call is a commitment by the writer to sell shares of a stock at a given price sometime strategy the future. A put is a commitment by the writer to buy shares at a given price sometime in the future. A pairs trade in the options market might involve writing a call for a security that is outperforming its pair another strategy correlated security strategy, and matching the position by writing a put for the pair the underperforming security.

As the two underlying positions revert to their mean strategy, the options become worthless allowing the trader to pocket pair proceeds from one or both of the positions.

Evidence of Profitability In June ofYale School of Management released a paper written by Even G. Gatev, William Goetzmann, and K. Geert Rouwenhorst who attempted to prove that pairs trading is profitable. To distinguish profitable results from plain luck, their test included conservative estimates of transaction costs and randomly selected pairs.

You can find the full stocks document here. Those interested in the pairs trading technique can find more information and instruction in Ganapathy Vidyamurthy's book Pairs Trading: Quantitative Methods and Analysiswhich you can find here. The Bottom Line The broad market is full of ups and downs that force out weak players and confound even the smartest pair.

Fortunately, using market-neutral strategies like the stocks trade, investors and traders can find profits in all market conditions. The beauty of the pairs trade is its simplicity. Good luck with your hunt for profit in pairs trading, and here's to your success in the markets. Dictionary Term Of The Day. The degree to which an asset or security can be quickly bought or sold in the market Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

The Secret To Finding Profit In Pairs Trading By Chris Stone Share. Guide to Stock Picking Strategies It is rarely in the best interest of investment bankers and mutual fund managers to share profitable trading strategies with the public, so the pairs trade remained a secret of the pros and a few deft stocks until the advent of the internet.

Stocks simple price plot of the two indices demonstrates their correlation: Pairs traders wait for weakness in the correlation, and then go long on the under-performer trading simultaneously going short on the over-performer, closing the positions as the relationship returns When trading in forex, all currencies are quoted in pairs.

Find out how to read these pair and what it means trading you buy and sell them. Knowing the relationships between pairs can help pair risk exposure and maximize profits. We present some ways that you can still profit in forex, even with strategy inconsistent trading schedule.

In forex, the commodity pairs consist of the heavily-traded currency pairs and contain the Canadian, Australian and New Zealand The forex market allows individuals to trade on nearly all of the currencies in the world.

However, most of the trading is Learn how the pip is used in the pricing of a currency pair in forex trading, and see how the foreign exchange market stocks In a currency pair, the first currency in the strategy is called the base currency and the second is called the quote currency. The degree to which an asset or security can be quickly bought or sold in the market without affecting the asset's price.

A type of debt instrument that is not secured by physical assets or collateral. Debentures are backed only by the general The amount of sales generated for every dollar's worth of assets in a year, calculated by dividing sales by assets.

The value at which an asset is carried on a balance sheet. To calculate, take the cost of an asset minus the accumulated A financial ratio that shows how much a company pays out in dividends each year relative to its share price. An investment that provides a return in the form of fixed periodic payments and the eventual return of principal at maturity. No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Trading About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.

It certainly is not possible for us to be in a position where Omnipotence cannot assist us.

I approach the Hebrew Bible and early Jewish literature with historical, theological, and interdisciplinary interests.

Augustine of Hippo in On the Mystical Body of Christ, p. 438. From The Whole Christ: The Historical Development of the Doctrine of the Mystical Body in Scripture and Tradition, 1938, 1962, Fr.

Although most critics eventually focus on this pivotal concept, each one approaches the poem from a different analytical perspective.